|

Bond Discounts & Premiums |

|

|

|

|

Bond Discounts & Premiums |

|

|

Bond Discounts & Premiums

Some bonds do not pay cash interest, but are purchased at a substantial discount from face value and then are redeemed at face value on the maturity date. These bonds are often called Original Issue Discount ("OID") or Zero Coupon bonds. Other bonds do pay cash interest, however, when they are purchased on the open market, they are priced at either a discount or a premium to face value.

U.S. tax law requires that taxes be paid on accrued income on discount bonds. The law also permits the amortized deduction of any premiums paid above face value. Captools/net provides two transactions for this purpose.

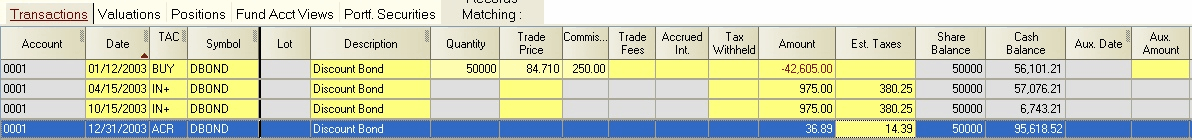

ACR - Accretion on Purchase Discount (non-cash transaction): Use for imputed interest earned on zero coupon or OID bonds. This entry is required to get correct tax reporting, and is usually entered at year-end, but does not affect valuations or before-tax ROI. Captools/net automatically adds accreted interest on the bond to its cost basis in order to generate correct capital gains and open lot positions.

You may calculate and enter accreted interest amounts yourself or alternatively use the Data/Compute Field command to calculate accreted interest. For the Compute Field command to work, the Security Id entry for the bond must indicate the maturity date and price. To execute the Compute Field command, move the cursor to the start of the Amount field of the ACR transaction and execute Data/Compute Field. You should see the proper ACR amount appear.

If the same issue of a discounted bond was purchased on several different dates, you must assign matching lot numbers to each original purchase transaction and to subsequent ACR transactions. Lot numbers of ACR transactions must match those assigned to the original purchase transaction.

Note: In general, unrealized gains on a coupon bond purchased at a market discount may be, but do not need to be reported to the IRS as accreted interest .

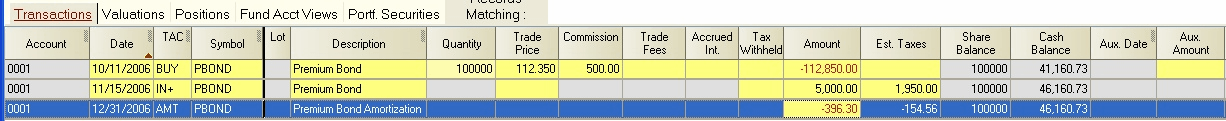

AMT - Amortization on Purchase Premium (non-cash transaction): Use this transaction to amortize a premium paid on the purchase of a bond. The amortization amount is usually entered at year-end, and may be entered manually or calculated using the Data/Compute Field (Ctrl+K) command in a manner identical to that used for the ACR accretion transaction described above. In the following example, a 10% bond purchased at a premium, has the premium amortized:

Note that the amortization amount is negative and sums to the total amount of the purchase premium ($300) at the date of sale. Note also that the accrued interest paid to the seller of the bond is not considered part of the premium. The commission and trade fees are also not included, so as to facilitate their immediate deduction.

If the same issue of a bond was purchased on several different dates, you must assign matching lot numbers to each original purchase transaction and to subsequent AMT transactions. Lot numbers of AMT transactions must match those assigned to the original purchase transaction.

ACR and AMT Computations - Captools/net computes accretion and amortization interest, for ACR and AMT transactions, using the maturity date, maturity price and accrual method specified for the security in the security list. The default discount rate assumed for this computation is the zero coupon rate applied to the discount from purchase to maturity. The maximum rate allowed by current IRS tax rules is the bond yield to maturity (YTM) at the time the bond was purchased.