|

Certificates of deposit |

|

|

|

|

Certificates of deposit |

|

|

Certificates of deposit

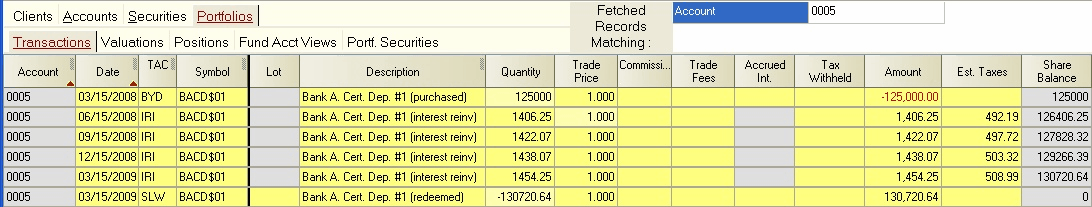

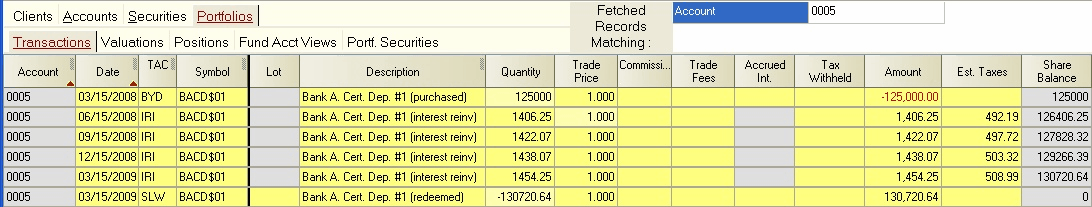

The treatment of certificates of deposit depends on whether interest is reinvested until maturity or is credited to another account. In the case where a C.D. has interest reinvested, the IRI transaction is used as follows:

If the C.D. payment dates and payment rates have been specified in the Security Id record, then highlighting the Amount field and clicking upon the Compute Field icon (or the Data/Compute Field command) will cause the computed payment to be entered in the Amount field (this may or may not match the amount computed by the paying institution, depending upon underlying assumptions about the computation methodology). Note also that the last interest payment in the example is treated as a reinvestment even though it is redeemed the same day.

If the interest on a C.D. is not reinvested, but is withdrawn in the form of a quarterly check from the bank, the series of transactions would appear as follows:

Note that in both examples above the base currency symbol "$" was embedded in the symbol so as to bypass the cost basis calculation. This is appropriate because it can be assumed that the C.D. is to always be valued at $1/share. If you want to suppress the reporting of the C.D. on the capital gains report, you should make a manual zero Est. Tax entry.