|

Commodity Futures |

|

|

|

|

Commodity Futures |

|

|

Commodity Futures

Captools/net is primarily designed in anticipation that most users are engaged in long term investment activity in equity and fixed income securities and in mutual fund products, with some occasional investments in other alternative investment products. Although commodity futures and their options do not fit that profile, they can be entered into and performance tracked in Captools/net, with the caveat that the treatment of such investments may not be quite as refined as for the more traditional assets, e.g. quote downloads may not be supported for commodities, this documentation may not be quite as thorough, etc.

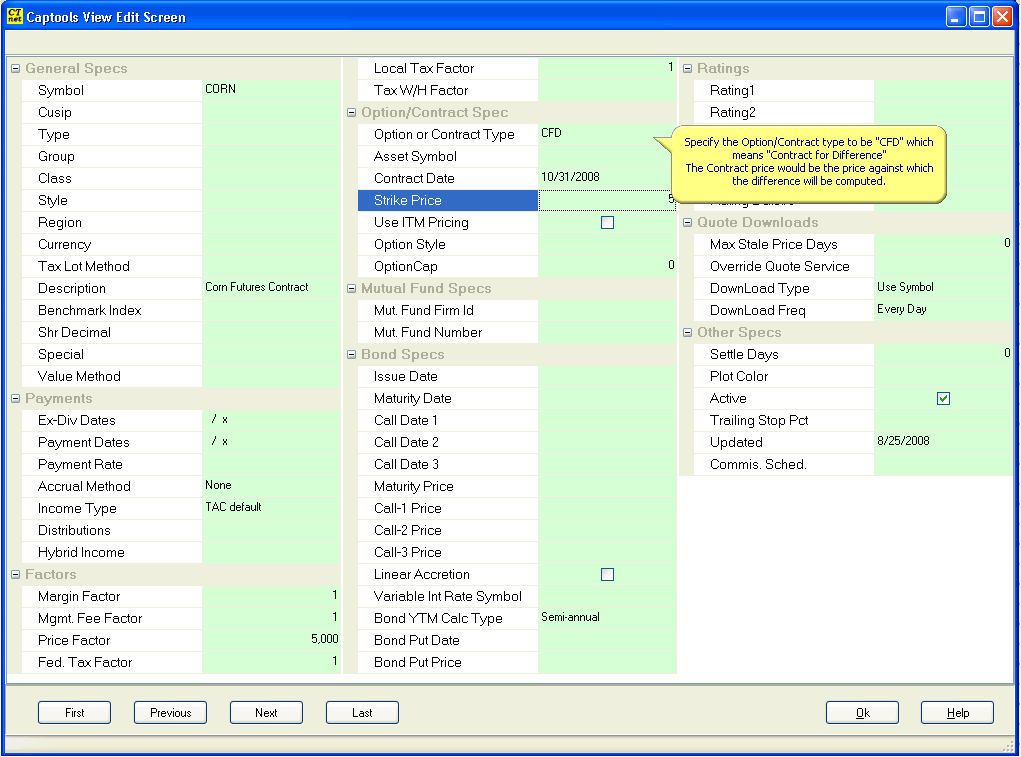

Security Id Record - Prior to adding a commodity position to your portfolio, you should set up a separate security record in the security list for each commodity contract or contract option being traded. The following view of a Security Id record for a CBT Corn Put option in the edit view mode:

The fields of interest are:

Symbol - The ticker symbol used should uniquely identify the contract or option and should not recur at a later point in time. The Chicago Board of Trade specifies symbols on their web site for commodities and options and provides a series of letters for the contract months (F,G,H,J,K,M,N,Q,U,V,X,Z for January - December). You can use these and extend this with the year to obtain a unique symbol, e.g. "C.U04" for the Corn, Sept 2004 CBT contract. Similarly the symbol for the $2.80 put option on this contract could be "OCP.U04.280". A 2.80 call option on this same contract would have the symbol "OCC.U04.280". (Note: the use of a unique symbol eliminates the need to indicate the strike price and date in the transaction Aux Date and Aux Amount as in earlier versions of Captools software).

Price Factor - This must be specified such that the quantity used (typically the number of contracts) times the quoted price, times the price factor produces the correct transaction amount. This is the amount that you or your client is liable for, even if it is not the out of pocket cash required due to the use of margin. The proper factor may vary from commodity to commodity. In the case of Corn, a single contract controls 5,000 bushels. Thus a price factor of 5,000 is appropriate as long as pricing is done in dollars.

Option/Contract Type - This field should be "CFD" or "Future" (preferred) for the underlying commodity futures contract. If dealing with an option on a contract, use "Put" or "Call" as appropriate.

Asset Symbol - This should contain the futures contract symbol for the contract or any of its options.

Contract Date - This should specify the date the commodity futures contract is due for the security representing the contract as well as for its options.

Strike Price - This should specify the strike price for options and the contract price for the underlying futures contract.

Use ITM Pricing - This specifies using "In the Money Pricing" if the security is an option. If this is set, the market quoted price of the underlying contract must be entered into the position records in lieu of the quoted price of the option. Securities specified as "CFD" or "Futures" should not have this checked.

Difference Pricing - If "CFD" or "Future' is specified for the "Option/Contract Type", the amount of the transaction will be computed as the quantity times price factor, times the difference between the trade price and the contract price.

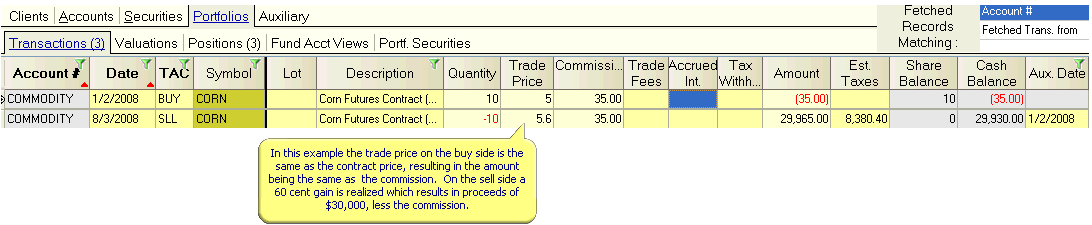

Portfolio Transaction Records - An example of the purchase and sale of corn futures contracts hedged by corn puts would appear as follows in the portfolio transactions. You can use "BUY" and "SLL" or "BOP" (buy option) and "SOP" (sell option) for the transaction code (TAC) if there will be cash debited or credited. Otherwise you can enter a zero amount:

The futures contract quantity has been denominated as "10" since the price factor in the security list was set at 5000 because there are typically 5 thousand bushels per contract. Additional transactions involving deposits of cash may be entered as needed to account for account minimums as required by your commodities broker.

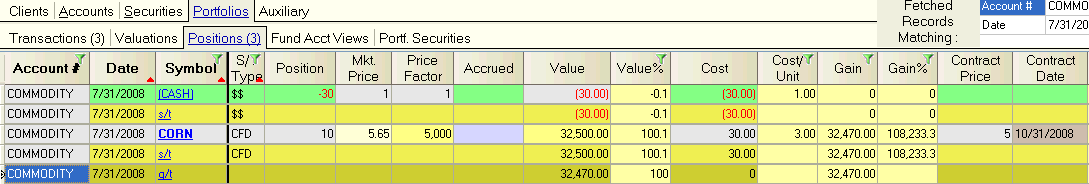

Position Records - Prior to the sale of the contract in this example, the portfolio was valued. The resulting portfolio position screen appears as follows:

The futures contract is valued at the current market price for the commodity, with the value computed based upon the difference between that price and the contract price. In this example the commodity position has a positive value. However, if the market price fell below the contract price on the date of the valuation, the value would be negative, and the account holder would typically be required to add to the cash position (see transaction records above) so the account can be settled on the contract date.

Short Sales - Short sales of commodity futures and futures options can be accomplished simply by using the SLS transaction code for the short sale of the option or contract and BYC for the covering transaction. The SLS transaction should always precede the BYC transaction.