|

DRIPs (Dividend Reinvestment Plans) |

|

|

|

|

DRIPs (Dividend Reinvestment Plans) |

|

|

DRIPs (Dividend Reinvestment Plans)

Many corporations have dividend reinvestment plans ("DRIPs") which permit you to purchase shares and to reinvest dividends in the corporate common stock without going through a broker. These plans usually require an initial purchase of at least a few shares from a broker. Additional shares, including fractional shares, can subsequently be purchased directly from the corporation via the plan. Drip plans provide the small investor the opportunity to build a diversified portfolio of common stocks with relatively little initial investment.

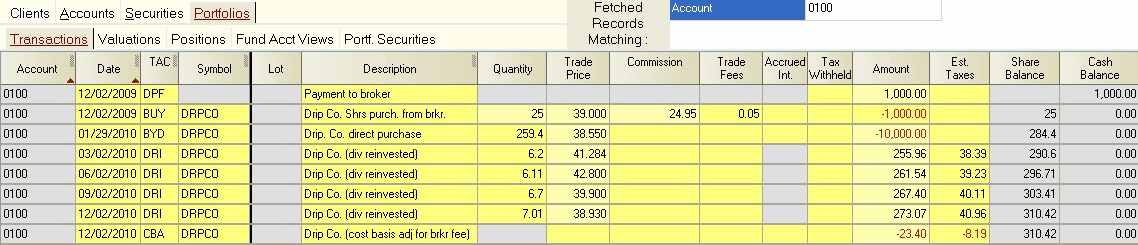

DRIPs can be handled in Captools/net using BYD and SLW transaction codes for the purchase and liquidation of shares, and DRI transaction codes for reinvested dividends. You may find the Mutual Fund transaction view format the most convenient transaction view to enter these transactions.

U.S. tax laws require that you be liable for tax on any commissions that the sponsoring corporation has absorbed as a part of the plan. Typically, you will be notified of the amount of these absorbed commissions on your DRIP statement at the end of the tax year. You can then use a CBA transaction to reduce your investment cost basis, thereby deferring the tax until the shares are liquidated:

Note: This example shows a trade fee, in addition to the commission, on the initial share purchase from the broker. This is for receipt of the share certificate for delivery to the Drip plan administrator.

If your tax advisor tells you that taxes on the absorbed commissions cannot be deferred until sale, then the Amount field entry for the CBA transaction would be positive and the estimated tax field not forced to zero.

If you are notified of the commission avoidance amount with each DRIP reinvestment or purchase, then you can enter the adjusted cost basis in the Aux. Amount field of the affected DRI and BYD transactions.