|

Expense Accrual and Amortization |

|

|

|

|

Expense Accrual and Amortization |

|

|

Expense Accrual and Amortization

Some users may desire to accrue or amortize large infrequent expenses over the period of time to which they apply, where an accrual will be used where the expense occurs at the end of the period and an amortization will be used when the expense (such as an advance paid management fee) is paid at the beginning of the period.

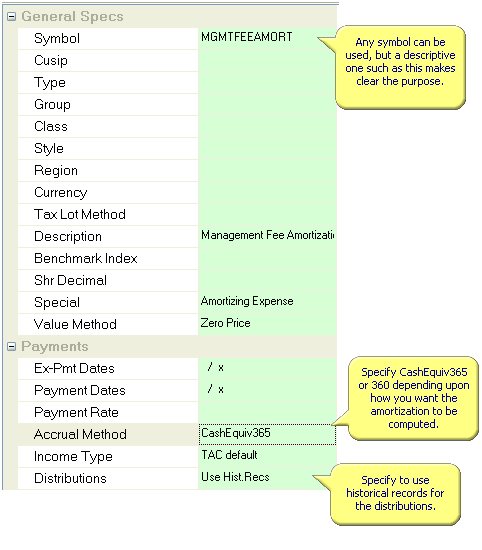

The "XAE" transaction is provided for this purpose for Captools/net users at level 4 and higher. Before using this transaction code you need to setup some "pseudo" security symbol to which you will specify properties as follows:

In the above example "MGMTFEEAMORT" is the symbol used. You could use "EXPENSEACCRUAL" for accruing expenses, or make up the appropriate symbol.

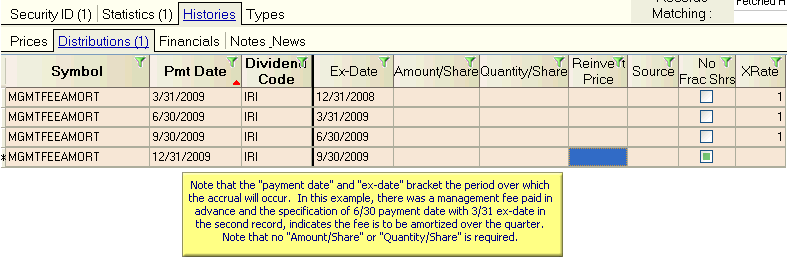

Next, the distribution records for the symbol are used to specify the applicable accrual or amortization period. These records only need to specify the "payment date" and "ex-date" along with an "IRI" TAC code:

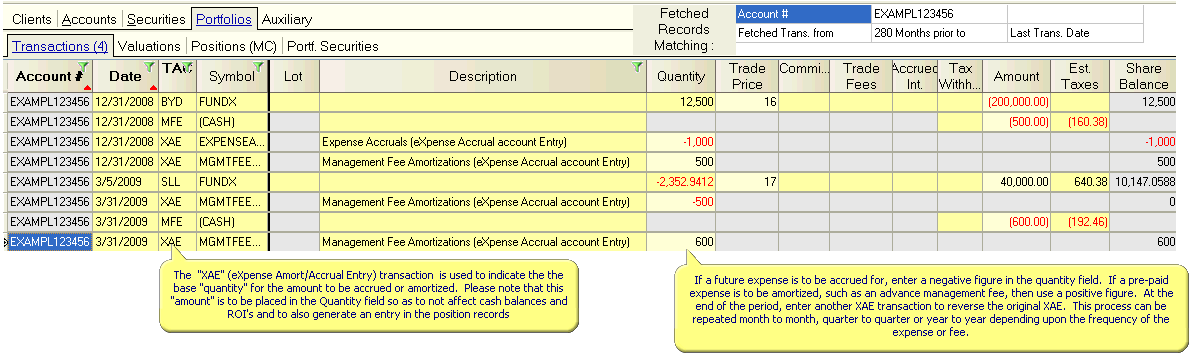

In the transaction records, use an "XAE" (eXpense Amortization/Accrual Entry) transaction to indicate the amount to be amortized or accrued. This amount is placed in the "Quantity" field so as to produce a separate entry in the position records and so as to not affect cash or cash flows. Amounts to be accrued should be entered as negative quantities, amounts to be amortized as positive quantities:

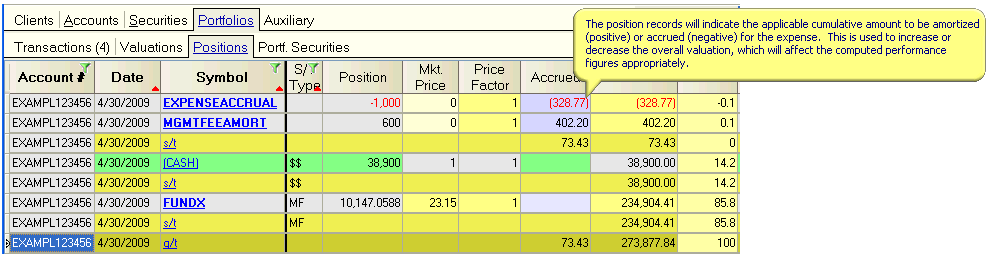

When the position records are generated, a separate record will appear for the expense being amortized or accrued, with the applicable amount appearing in the "Accrued" column.