|

Fund Parameters |

|

|

|

|

Fund Parameters |

|

|

Fund Parameters

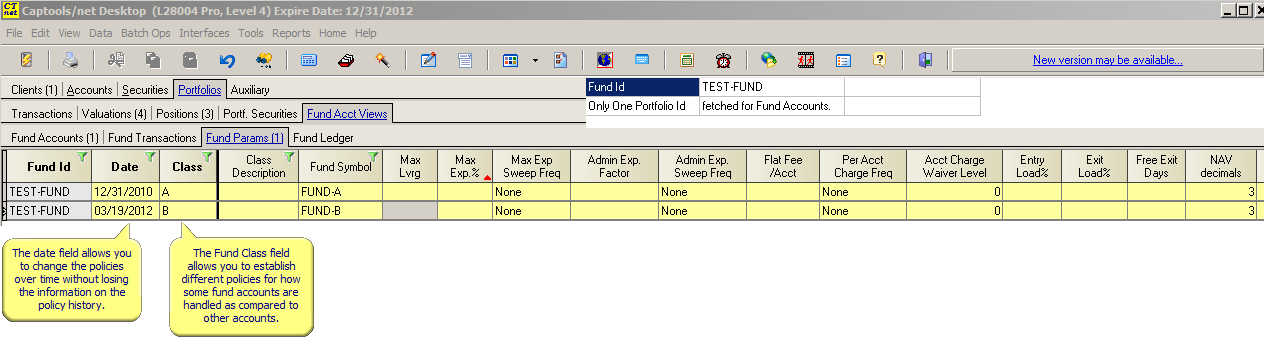

The Fund Parameter records permit you to define different account parameters classes of accounts you have defined within the fund:

The records can be edited in the grid, or alternatively in "form" format by double-clicking on the record or by clicking on the "Data/Edit Record" command:

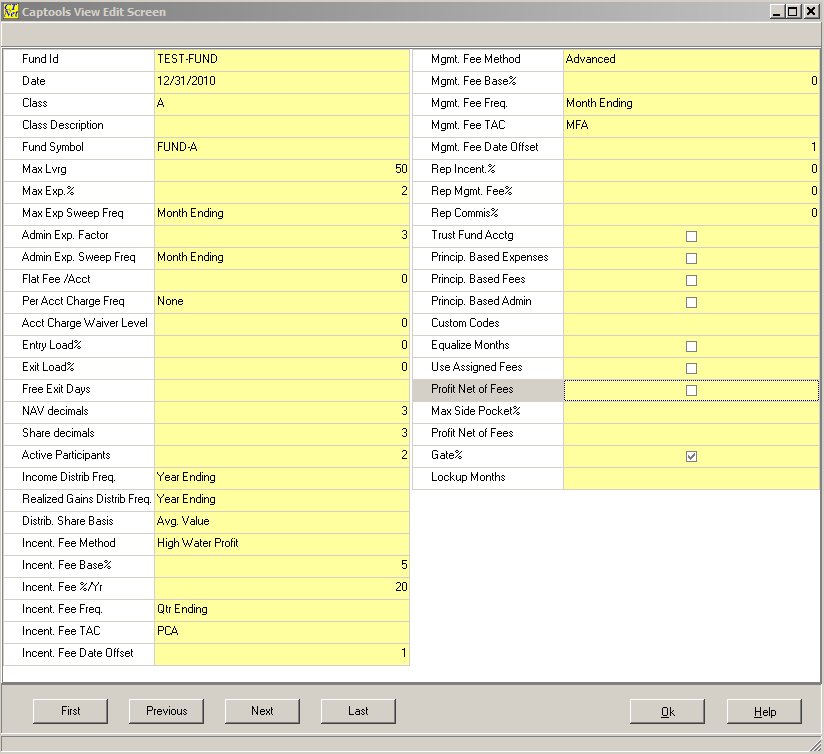

The Fund Parameter fields operate as follows:

Fund Id - Account # of the fund as it appears in the main Account table.

Date - Record date. Multiple records can exist for a "Class", with the most recent one prior to the applicable date used when queried for a parameter.

Class - The key field used to look up the parameter record, matched from the "Class" assigned in the "Fund Account" record.

Max Lvrg - Indicates the maximum investment leverage desired for this class of fund participants.

Max Exp.% - Indicates the maximum expenses to be charged to participants of the class as a percent of value/year.

Max. Exp. Sweep Freq. - Indicates the maximum frequency with which expense records are to be generated for this class of users.

Flat Fee/Acct - Indicates any flat fee (in $) to be charged to accounts of this class.

Per Acct Charge Freq. - Indicates the frequency of the flat fee charge.

Acct Charge Waiver Level - Indicates the asset level at which a flat fee is waived.

Entry Load% - Indicates the percent load charge to be applied to new monies entering the fund.

Exit Load% - Indicates the percent charge to be applied to monies exiting the fund.

Free Exit Days - Indicates the number of days after entry within which monies can be removed without an exit charge.

NAV Decimals - Indicates the decimal precision to which the "Net Asset Value" per unit is to be maintained.

Share Decimals - Indicates the decimal precision to which the share accounting is maintained.

Active Participants - This is a computed field intended to enumerate the number of participants in the class.

Income Distrib Freq. - This indicates the frequency with which income transactions are to be distributed for the class.

Realized Gains Freq. - This indicates the frequency with which realized gains are to be distributed for the class.

Distribution Share Basis - This indicates what share basis is to be used to compute distributions.

Incent. Fee Method - This indicates the default incentive fee method to be used for the class. See the prior topic Fund Accounts for the enumeration of the methods.

Incent. Fee Base % - This indicates the default incentive fee base "hurdle" rate.

Incent Fee %/Year - This indicates the default incentive fee rate as a percent.

Incent Fee Freq. - This indicates the frequency that incentive fees will be charged, subject to high water rules.

Incent Fee TAC - This indicates the default transaction code to be used for incentive fees. See the topic Fund Transaction Codes for available codes

Incent Fee Date Offset - This indicates the number of days after the fee period end date that a fee transaction is charged. Typically this should be 1 day.

Mgmt Fee Method - This indicates the default fee calculation method for the management fee. See the prior topic Fund Accounts for the enumeration of the methods.

Mgmt Fee Base% - This indicates the management fee rate expressed as a percent per year. Some accounts may be discounted from this based upon special status.

Mgmt Fee Freq. - This indicates the frequency that management fees will be charged.

Mgmt Fee TAC - This indicates the default transaction code to be used for management fees. See the topic Fund Transaction Codes for available codes

Mgmt Fee Date Offset - This indicates the number of days after the fee period end date that a fee transaction is charged. Typically this should be 1 day.

Rep. Percent Rates - These three fields indicate the portion of fees and commissions that any assigned rep. will be assigned.

Trust Fund Acctg - This specifies that Trust Fund Accounting is activated, but will be overridden if the main fund account record indicates that trust fund accounting is active.

Princip Based Expenses/Fees/Admin - If these are checked, they indicate that fees are to only be applied based upon principal values, not income attributed values.

Custom Codes - Reserved.

Equalize Months - Specifies that time period computations will assume months and quarters of equal length.

Use Assigned Fees - Specifies that fees will be "accrued" rather than charged in cash as a default. This will be overridden by the specification in the transaction generation tool.

Profit Net of Fees - Specifies that the profit used for incentive fees is reduced by the amount of the prior periods fees.

Max Side Pocket% - Reserved.

Gate % - Reserved.

Lockup Months - Reserved.