|

Money Market Funds |

|

|

|

|

Money Market Funds |

|

|

Money Market Funds

Money market funds may be handled in one of two ways in Captools/net. They can be treated as mutual funds which happen to always have a price of $1/share (or in whatever currency you are using). Alternatively, if you only have a single money market fund in a portfolio, you can let the portfolio's Cash balance substitute for the money market fund balance, as described below in the Cash Accounting methodology.

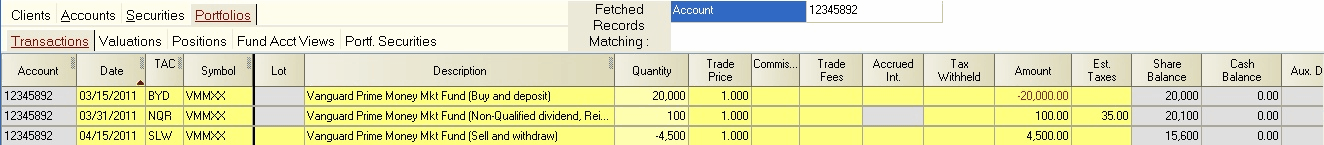

Share Accounting - Although a money market fund is often used like a bank account, per the IRS, it is technically a mutual fund requiring share accounting treatment. BUY, SLL, (or BYD & SLW) and IRI or NQR transactions can be used to achieve this by employing transactions similar to the following to indicate flow of funds into and out of the money fund:

When you perform valuations, the money market shares must be valued at $1/share (or 1 DM/share, or 1 Fr/share, whatever the base currency unit). If you embed the account base currency symbol (e.g., "US$" or just "$") at the beginning or end of the ticker symbol (e.g. "$MMF" or "MMF$", or "MMF-US$"), or use a 5-character ticker symbol ending in "XX", e.g. "VMMXX" Captools will recognize that the security is a money market fund and automatically value it in this fashion. Cost basis computations are also bypassed when this symbol notation is used, thereby speeding generation of some reports and valuations.

Use of the money market symbol notation also suppresses the generation of an entry on the capital gains report for money market sell transactions. Note that since the money fund doesn't have capital gains, you may omit use of the tax lot number without concern for transaction matching.

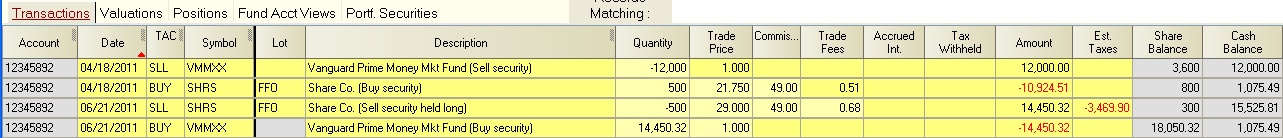

A SLL transaction is used to transfer money out of a money market fund to purchase other securities, and a BUY transaction moves money into the money market fund after selling other securities, e.g.,:

Cash Accounting - As previously noted, an alternative to using share accounting for your money market fund is to use cash accounting if you only have a single money fund. Cash accounting merely involves depositing funds to the portfolio without buying any money market fund shares. These funds are then treated as a part of the cash in your portfolio. When interest is paid on the fund, simply make an IN+ or NQD entry using your money market fund symbol in the symbol field (money fund "interest" is technically a dividend for U.S. taxpayers, use IN+ if you want it reported as interest, NQD if you want it reported as a non-qualified dividend).

The cash accounting approach is generally easier to use than the share accounting approach because it requires fewer portfolio transaction entries. The primary disadvantage of the cash approach is that it does not permit a meaningful ROI to be computed for the money market fund. This is because various account fees are often deducted from portfolio Cash, causing its ROI to be artificially reduced.