|

Portfolio Rebalancing |

|

|

|

|

Portfolio Rebalancing |

|

|

Portfolio Rebalancing

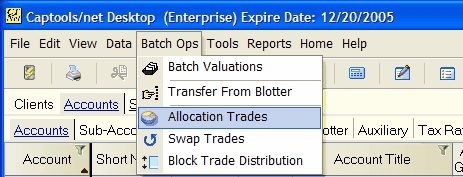

Level 2 and higher Pro and Enterprise versions of Captools/net provide two tools for rebalancing client portfolios, with some features limited to higher versions. These are the Allocation Trade and Swap Trade functions accessible from the Captools/net Batch Ops submenu:

The Allocation Trade Generation function compares current account holdings versus the allocations that you specify for an account in the allocation records, and then generates the proposed trades that would be necessary to bring the portfolio close to the same holdings percentages as the allocation records.

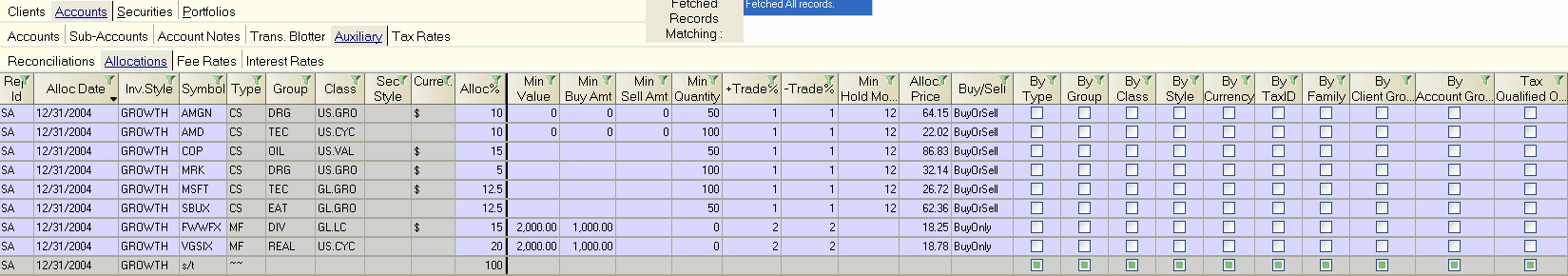

Allocation Records

In order to generate allocation driven trades, you need to first set up your allocation records to specify allocations for one or more Investment Styles. Captools/net also treats the allocation records as the "Model Portfolio" for reporting purposes for accounts that are assigned the investment style specified in the record.

This example shows one investment style, however any number of styles may be defined and maintained in this table. The data fields in these records operate as follows:

Alloc. Date - This is the record date. It should be the date on which you intend for that style to start being applied for accounts that use the style. If you change your allocation, it is good practice to create new records for the style, dated the change date. This can most easily be done by selecting the most recent records of the style and then executing the Data/Duplicate command. The new records will be inserted with the current date. You can then edit that date and other record values to create your new allocation specification.

Inv. Style - This is a short piece of text which uniquely identifies the investment style. An account is assigned a style by assigning a matching text in the account's "Investment Style" field.

Symbol - This field specifies a security to be added to or increased in the client's portfolio during re-balancing if the portfolio allocation falls below the allocation percentage specified in the Alloc% field.

Min Value - This is the minimum value holding you want for the security in the portfolio. A security will not be added unless this value can be reached with the specified allocation. This can be used to implement minimum entry requirements imposed by mutual funds.

Min Buy Amt. - This specifies the minimum incremental money amount to be added during rebalancing. This can be used to implement mutual fund incremental addition restrictions.

Min Sell Amt - This specifies the minimum incremental money amount to be removed during rebalancing, except that if the total value is less than this amount it will be liquidated.

Min Quantity - This specifies the minimum incremental buy or sell share quantity. For funds this should be the minimum quantity recognized by the fund, for stocks it should be the minimum lot size that you want to trade.

+Trade% - This allows you to implement minimum buy trade size in percentage terms. If the minimum quantity or minimum buy amounts are more restrictive, those will apply.

-Trade% - This allows you to implement minimum sell trade size in percentage terms. If the minimum quantity or minimum sell amounts are more restrictive, those will apply.

Min Hold Months - This field allows you to specify that a position will not be sold until held for the minimum period specified.

Alloc. Price - This field specifies the assumed trade price for the rebalancing. This should be the most recent available quote price. You should understand that the actual trades may not be able to be executed at exactly this price, so the rebalancing will be approximate. If this field is empty or needs to be updated, highlight it and click on the Compute icon or the Data/Compute command.

Buy/Sell - This control allows you to specify whether a security can be only bought or only sold as well as permitting you to allow both actions.

By Type, By Group, By Class, etc - These fields allow you to specify that the rebalancing is to be done by the selected category, such that a security belonging to a category will not be sold merely to buy a security of the same category, e.g. if By Group is used, an energy stock in a portfolio would not be liquidated simply to buy the energy stock specified in the allocation records.

By Tax ID, By Family, etc. - These fields allow you to specify that the rebalancing span more than one account provided they have the same Tax ID or Family identifier.

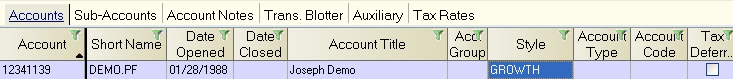

Account Records

Once you have defined one or more Investment Styles in the allocation records, you need to assign a style to each account that you want to re-balance. This is done in the Style field of the Account record:

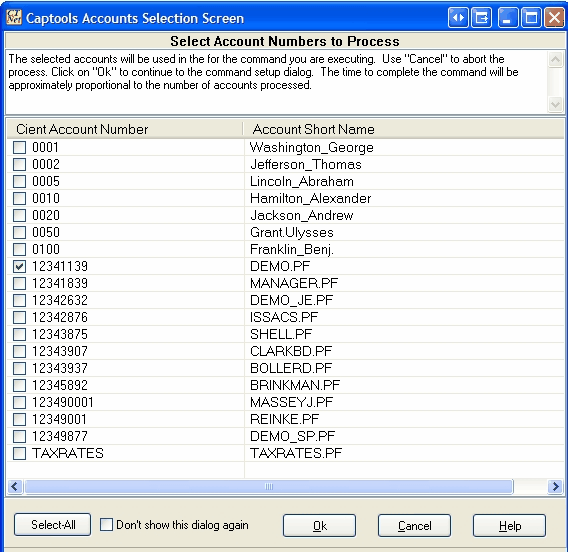

To execute the rebalancing, click on the Captools/net desktop Batch Ops/Allocation Trade command to get the following dialog, which permits you to select the accounts you wish to rebalance:

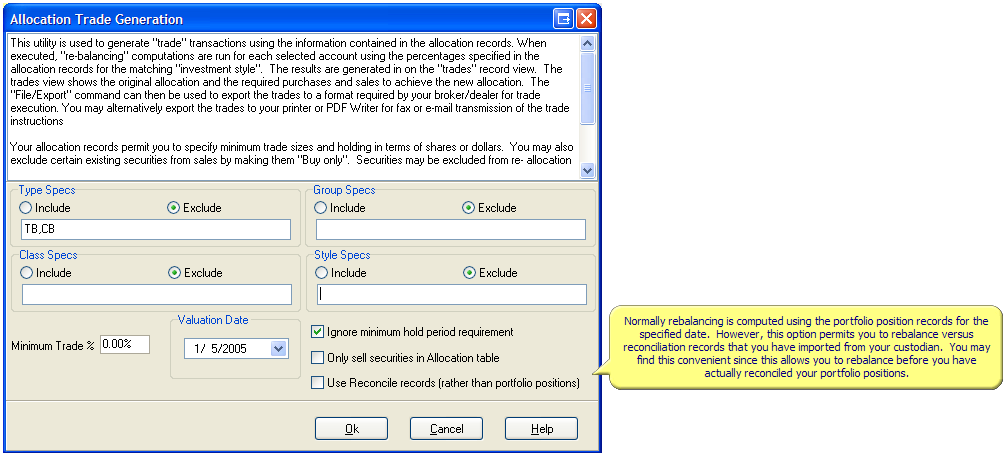

Next, click Ok to get the setup dialog. This contains some instructions, as well as controls permitting you to include or exclude securities base upon security type, group, class or security style (this is not the same as investment style). You can also specify trade percentage limits (Minimum Trade%) on securities not contained in the allocation records, as well as override other trade controls:

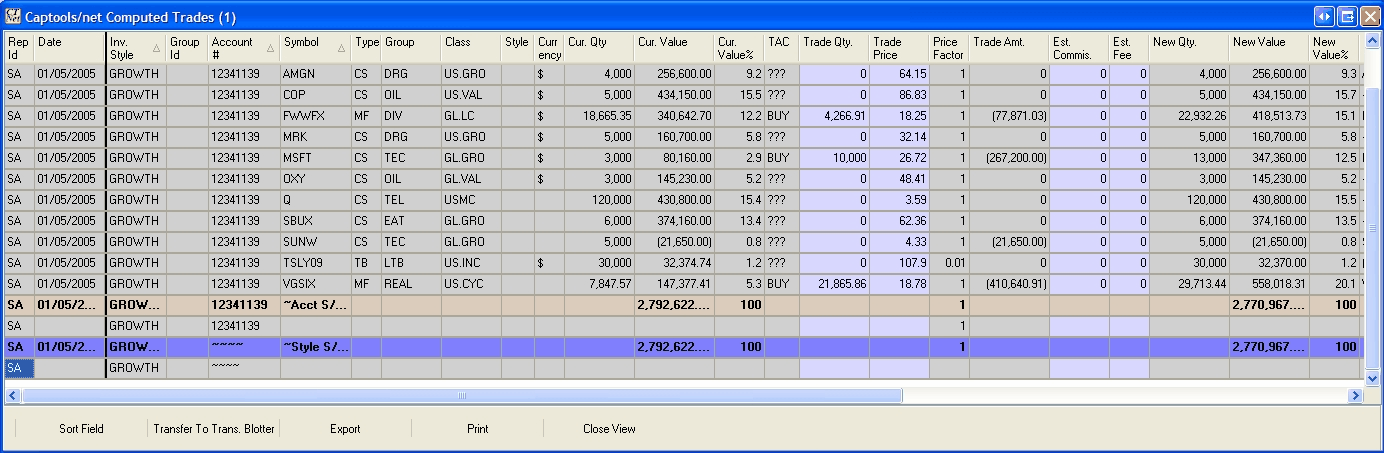

Upon clicking Ok, the computed trades are displayed in a temporary table. Securities which are not to be traded are included (with a TAC of "???") for information.

The results may be sent to the transaction blotter, from where you may export them using Captools/net export function, or you may click on the Export button to export to formats specified by various custodians, which generally can then be uploaded through the custodian's website to execute the trades.

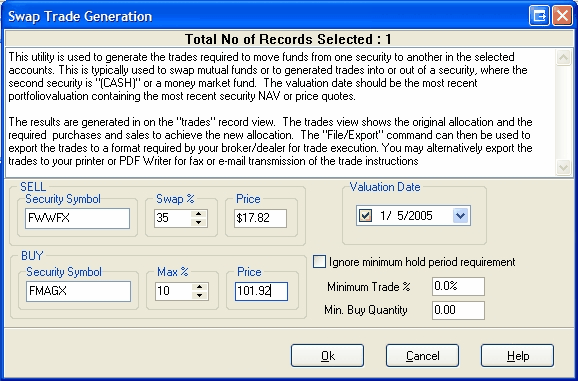

The Swap Trade Generation function allows you to execute a partial portfolio rebalancing by exchanging all or part of a security for another, or by trading into or out of cash into a security. This is particularly useful for money managers who are using mutual funds within the same fund family, or who are using funds through a brokerage "fund supermarket". Clicking upon the Batch Ops/Swap Trade Generation function produces the account selection dialog (same as for allocation trades above), and then takes you to the swap trade dialog as follows:

This example shows the exchange out of one fund into another, with 35% of the first funds holdings specified to be sold to buy the second fund, subject to the constraint that the second fund comprises no more than 10% of the portfolio.

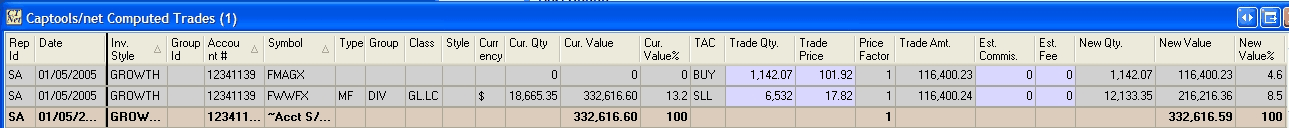

This produces the following computed trade table, which can be transferred to the transaction blotter or exported as described for the allocation trades in the prior topic.

If you want to trade into or out of cash, the symbol "(CASH)" must be used for the cash symbol.

Rebalancing Margin Accounts

The Allocation and Swap trade functions support rebalancing of margin accounts at the Pro and Enterprise versions operating at the Pro-3 level or higher. When an account is marginable as indicated by a greater than zero Max Margin% in the account record (Account Mgmt tab when edit record), then Captools/net will allow the Cash balance to go negative up to the margin limit during the rebalancing computations. To specify a margin balance in the allocation records, specify a negative allocation percentage in the record for "(CASH)".