|

Quick Portfolio ROI |

|

|

|

|

Quick Portfolio ROI |

|

|

Quick Portfolio ROI

Some Captools/net users need to obtain ROI performance on one or more portfolios, but do not have the time or data to enter all historical transactions.

Since total portfolio ROI depends only upon deposit and withdrawal transactions, plus beginning and ending values, you can set up a "Quick ROI" portfolio containing only these types of transactions.

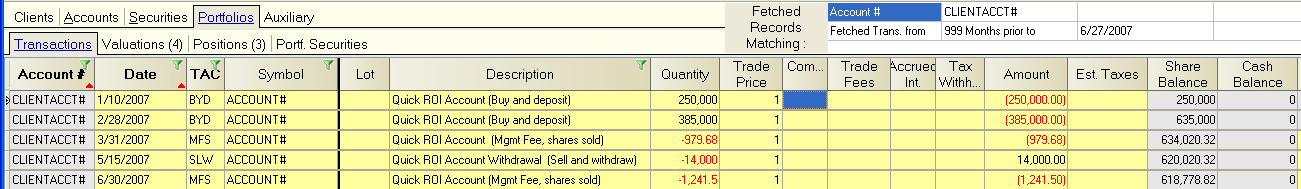

Rather than entering deposits and withdrawals as DPF and WDF transactions, enter these as BYD for the deposit transactions, and SLW for the withdrawal transactions, and an MFS for management fee transactions. For the transaction symbol, use the name or account number of the account being tracked. For the quantities, enter the amount of the deposit or withdrawal and then enter a price of "1.0". The resulting transaction screen would appear as follows:

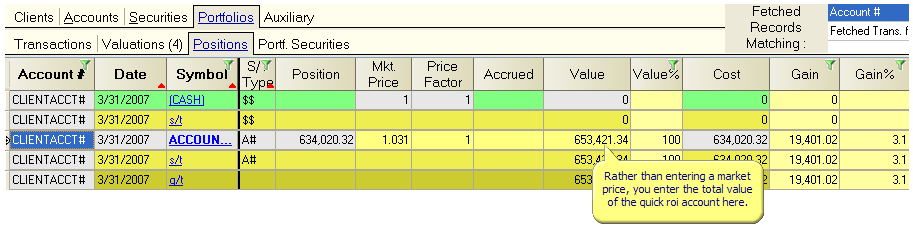

Before running an ROI report for the Quick ROI portfolio, you must create at least an ending valuation. You may also enter periodic valuations if you are interested in obtaining time-weighted as well as dollar weighted ROIs. On the position screen for these valuations, each account contained in the Quick ROI portfolio will appear as a single line item holding. Enter the value of each portfolio in the Value field (not the price field) as shown in the following example:

You can now use the Reports command to run an ROI report. If you run an ROI by Security type report, you will see the ROI for each quick portfolio contained in QuickROI.pf. You will also see the total combined ROI for all such portfolios.

Importing Data for Quick ROI

Since data for a Quick ROI as described above does not have securities transaction nor securities holdings detail, the valuation records cannot be created from the transaction records or be priced using security market prices. Data for Quick ROI accounts can be manually entered and valued as shown in the above examples. However, if you have historical data in a comma separated or fixed text format, you may be able to import this data into Captools/net as follows:

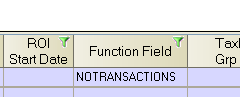

"NOTRANSACTION" Account

You first need to create the applicable account record(s) specify that the account(s) will not compute valuation positions from transactions. This is done by entering the notation "NOTRANSACTIONS" in the "Function" field of the applicable account records, e.g.:

Transaction Data

Import your transaction data into the Captools/net Transaction Blotter using a "Generic Import" template described in the topic Generic Imports. When you set up your import template, bear in mind that the symbol field needs to contain the account number. If you have multiple accounts you can also import the account number into to "Client Account" field if you want separate accounts, or you can use a dummy account number ("QUICKROIS") as in the above example. Transaction amounts should be imported into both the Quantity and Amount fields, and transaction codes will generally be limited to "BYD" for deposits, "SLW" for withdrawals and "MFS" for management fees.

Valuation Data

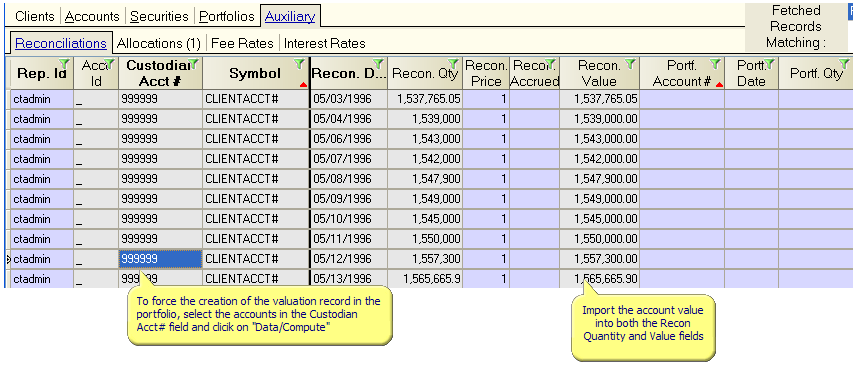

Import your valuation data into the "Auxiliary/Reconciliation" Table. The B/D account number needs to contain the same account number as used in the Transaction "Client Account" field, and the Symbol field should import the "Account" number imported into the symbol field for the transaction blotter import. The "Recon. Qty" and "Recon. Value" fields should both be set up to import the total account value for a given date, e.g.

Upon completion of import of your valuations into the reconciliation table, select the applicable records in the "Custodian Acct#" field and click on the compute icon (or "Data/Compute" command) to commence the movement of the valuations to the portfolio valuation records.