|

Sell Short / Cover |

|

|

|

|

Sell Short / Cover |

|

|

Sell Short / Cover

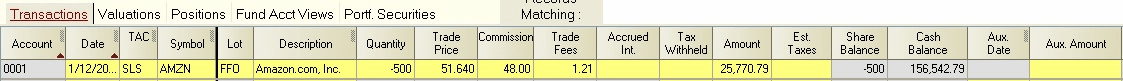

SLS - Sell Short (proceeds to cash): Use whenever a security is sold short. A short sale must always be closed using one or more "Buy to Cover" (BYC) transactions containing a matching tax lot assignment.

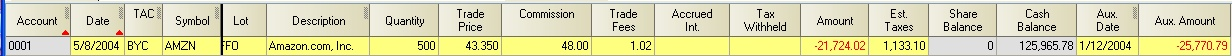

BYC - Buy to Cover Short Position (payment from cash): Use whenever a security is purchased to cover a short position. A "Buy to Cover" transaction must be preceded by one or more Sell Short (SLS) transactions of equal or greater combined share quantity and containing matching tax lot assignments.

Short sellers in the U.S. should be aware that short sales are subject to a tax rule which affects the capital gains holding period for securities when simultaneous long and short positions are taken in the same security:

Short Sale Rule - If you sell a security short while holding a substantially identical security short-term, or you acquire a substantially identical security before covering the short sale, then any gain on the short sale is short-term, and the holding period is suspended on the same number of shares held long while the short position was held.

The net effect of this rule is that short-sell/cover transactions are considered short-term unless the covering shares were already held long-term at the time of the short sale. Captools/net's estimated tax calculation treats all short sell/cover transactions as short-term. A manual Estimated Tax entry must be used if your short sale qualifies for long-term treatment.