|

Stocks |

|

|

|

|

Stocks |

|

|

Stocks

Correct treatment of common or preferred stock shares in Captools/net portfolios requires correct entry of purchase, sale, dividend and split transactions and proper valuation pricing.

In general, stock purchase transactions will be entered using a BUY transaction. BUY transaction payment is made by debiting the portfolio cash account. If the portfolio is not a margin account, funds must be deposited or another security must be sold to provide sufficient cash to restore the cash account to a zero or positive balance.

Stock sale transactions will typically be entered using a SLL transaction code. The sales proceeds are then automatically credited to the portfolio cash account. These proceeds can be withdrawn or used to purchase other securities.

Cash dividends should be entered using a DV+ transaction, which will credit the dividend amount to cash. If applicable, a separate BUY transaction, using a money market symbol is then used to sweep excess cash account funds into a money market fund.

Share dividends or splits should be entered using a SP+ transaction code. The share quantity for a split transaction should be the number of additional shares that are received into the portfolio as a result of the split. Thus, if the portfolio has 100 shares of a security and it splits "2/1" or has a "100% share dividend", then the split transaction will indicate 100 shares.

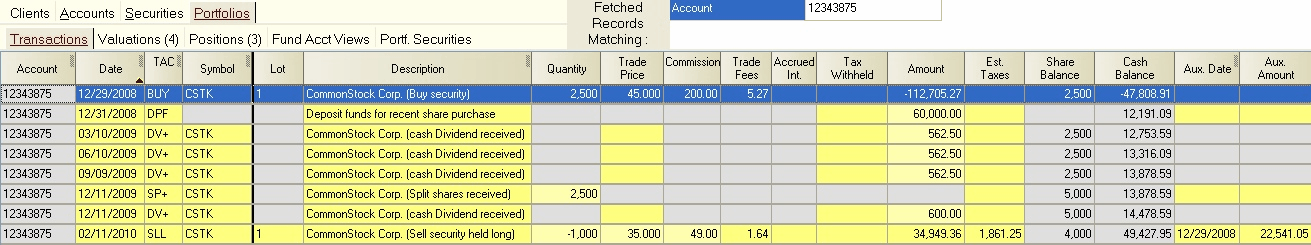

The following is an example of a series of portfolio transactions typical for common stock shares. These show the purchase of the stock, deposit of funds to pay for the purchase, dividends received, a 2 for 1 stock split, and sale of some of the shares:

In the above example, a "specific" tax lot number was assigned. See Tax Lots and Cost Bases for more detail on tax lot assignments.