|

Tax Computations |

|

|

|

|

Tax Computations |

|

|

Tax Computations

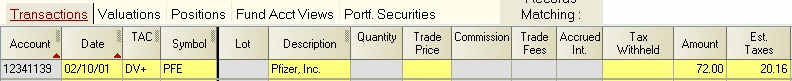

Captools/net portfolio transactions' "Est. Taxes" field is used to hold the value of the estimated tax liability incurred due to each transaction as shown in the following example:

This field is normally computed when a transaction is posted after being newly entered or after being modified. It can also be computed by selecting the field and executing the "Data/Compute" command or by clicking on the "Compute" icon.

The "Estimated Tax" computation is dependent upon data from several different records as follows:

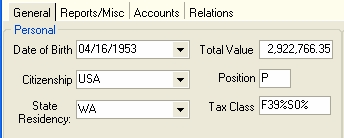

Client Record / Tax Class - The client record associated with the portfolio's account must specify a Tax Class, which is used to look up the proper tax rates from the Tax Rates records.

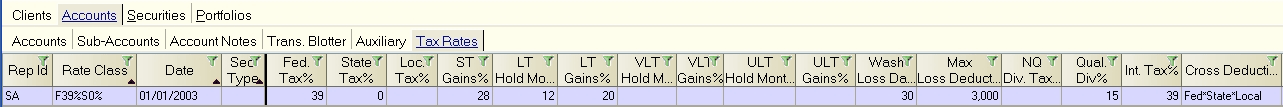

Tax Rates Records - These records specify the tax rate to be used, based upon the Tax Class, the date and TAC code of the transaction in question. The type of the security involved in the transaction may also optionally determine which rate will be used:

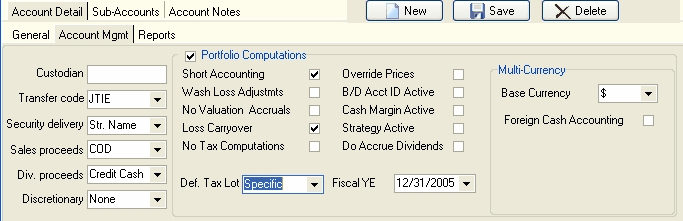

Account Record - The account record associated with the portfolio transaction contains a number of fields which affect how the transaction's estimated tax is computed. These can be set in the Program Preferences under the "Account Options" tab to apply to all accounts, or can be overridden at the account record level, where they are contained in the "Portfolio Computations" group under the "Account Mgmt" tab in the account "Edit" view:

Wash Loss Adjustments - When this is checked, wash loss sale transactions will be inserted into the portfolio when a loss sale is followed by a re-purchase of the security prior to the passage of the number of days specified in the "Wash Loss Days" field of the Tax Rates records (see above). Users whose tax laws have no such prohibition against wash loss sales should check this options.

Loss Carryover - Specifies that year-end loss carryover transactions be generated. Loss carryover transactions are generated when fiscal year-end valuations are computed if the net realized capital gains for the year is a loss exceeding the allowable deductible loss as specified in the tax rate records.

No Tax Computations - This field when checked suppresses computation of estimated taxes in the portfolio transactions, which may be desired for processing speed reasons when dealing with accounts for which estimated taxes will not be reported.

Default Tax Lot - Specifies the tax lot methodology to use for transactions in this account, provided that a Tax Lot methodology has not been assigned in the Security Id record for the transaction symbol. See Tax Lots and Cost Bases for more details on tax lot methodologies.

Fiscal Year End - Specifies the month and day of the accounts fiscal year end. Valuations whose month/day matches the fiscal year end will have Loss Carryover and Tax Adjustment records inserted, if necessary, and if these options are set (see next two items).

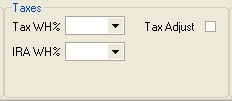

Several additional tax-related fields appear in the "Taxes" group on the "Account Mgmt" tab as follows:

Tax WH% & IRA WH% - These specify withholding to be applied to account transactions in the "Tax Withheld" field. These are computed only if a transaction is manually entered.

Tax Adjust - This field specifies that a year-end tax adjustment record be generated, if necessary, when the fiscal year-end valuation is computed. This record adjusts for the "netting" that occurs on the U.S. capital gains tax reporting form Schedule "D" when short term and long term gains have opposite signs, i.e. one is a loss and the other is a gain. This will give a more precise estimate of tax liability incurred by investing activity for purposes of computing after-tax ROI performance.

You should note that both the loss carryover and tax adjustment transactions cannot be attributed to any particular security. Accordingly, use of these will require you to select the option to include the "Portfolio/Other" category when reporting performance by security. See Performance Reports for more details.

Tax Deferred - This account record field (appears on Account Detail/General tab when in "Edit" view), when checked, generates an estimated tax of zero for all transactions.

Security Id Record - This record contains several fields which can affect how portfolio estimated taxes are computed:

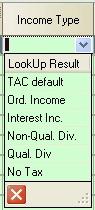

Tax Lot Method - This field specifies the tax lot method to be used for the security. If this is blank, or "unassigned" then the tax lot method specified at the account level (see "Default Tax Lot" item above) is used. The "TAC default" option specifies that the portfolio transaction code be used to determine the income type. If one of the other options is selected, than that type of income will be assumed when the applicable tax rate is looked up in the Tax Rates table. You should note that the prior version of Captools software assumed that certain symbols represented money market funds and therefore were of Income Type "Interest". Captools/net now relies upon the setting of this field to indicate the income type for tax purposes. See Tax Lots and Cost Bases for more details on tax lot methodologies.

Income Type - This field specifies how income distributions from this security are defined for tax purposes:

Fed Tax Factor - This factor is applied to increase or reduce the federal tax rate retrieved from the Tax Rates table for this security.

Local Tax Factor -This factor is applied to increase or reduce the state and local tax rate retrieved from the Tax Rates table for this security.

Portfolio Security Record - The Local Tax Factor field in this record can be used to modify the Local Tax Factor retrieved from the security list record. Since the Local Security record is tied to a specific account, this allows you to adjust for accounts subject to different local tax rates on a given security, as may be the case with municipal bonds.