|

Wash Loss Sales |

|

|

|

|

Wash Loss Sales |

|

|

Wash Loss Sales

The U.S. federal tax code contains wash sale and short sale rules, which prevent a U.S. taxpayer from realizing loss deductions or long-term capital gain benefits through the use of wash sales or certain short sales. Wash sale rules are complex, however, the following is a greatly abbreviated summary:

Wash Sale Rule - You are a private investor and you purchase, or buy an option to purchase, a security within a period extending from 30 days before to 30 days after the sale of a substantially identical security. The sale transaction is a "wash sale". You are not allowed to deduct any loss on the sale transaction.

The complete set of situations subject to wash sale rules is rather complex. Captools/net attempts to detect the most common of these situations. When it does detect a wash sale, Captools/net automatically adjusts the cost bases to reflect that losses are disallowed.

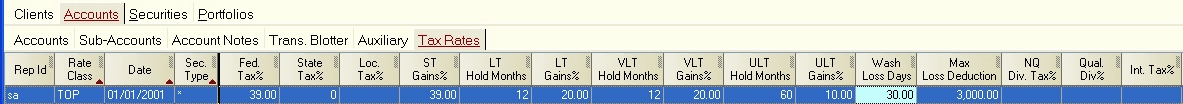

Wash Days - For wash sale cost bases adjustment to automatically occur, "Wash Days" must be properly specified in the tax rate records, e.g.,: