|

Bonds |

|

|

|

|

Bonds |

|

|

Bonds

Correct treatment of bonds in portfolios requires correct security list entries as well as correct entry of purchase and sale transactions and proper valuation pricing.

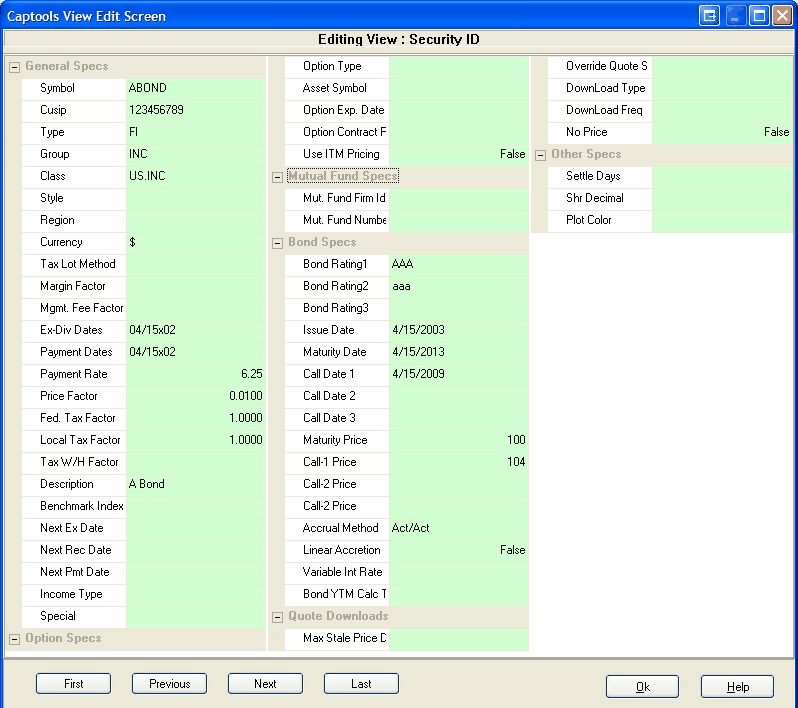

Security ID Record - A bond Security Id record must contain the correct price factor and correct specification of the bond Payment Dates, Payment Rate, Maturity Date and Maturity Price. A bond's Price Factor will usually be "0.01" if the bond is to be priced with a par price of 100. An example of a typical bond record in the Security Id table, as seen in the record Edit View, appears as follows:

Payment Dates are in the format "mm/ddxnn", where "mm/dd" is the month and day of the first payment of the calendar year and "nn" is the frequency, typically two times a year. Thus, for a bond paying on 4/15 and six months later on 10/15, as in the above example, the notation would be "04/15x02". (Note: if the specified payment date is greater than or equal to the last day of the month, all payment dates are assumed to be end-of-month).

Payment rates are entered in the Payment Rate field and must be entered as annual figures consistent with the bond's par pricing. Thus, a 9% bond with a par price of 100 would have a payment rate of "9.00".

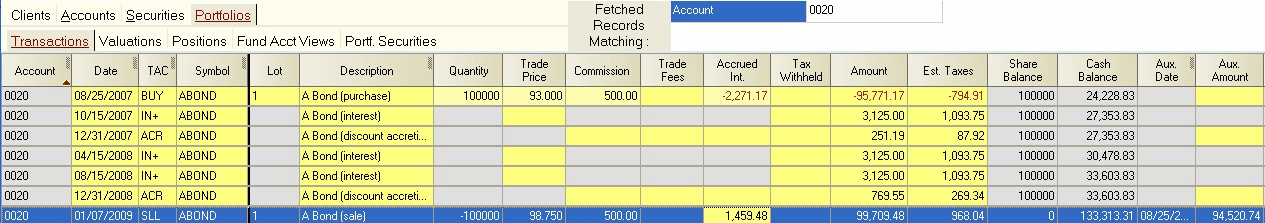

Portfolio Transaction Records - Bond quantities, when purchased into the portfolio should be identical to the total face value of the bonds. Thus, if $100,000 of a bond issue is purchased on the market at a discount for $93,000, the quantity entered in Captools will be "100,000", and the amount would be "93,000" plus any commission and accrued interest paid, as shown in the following example:

While a bond is held, interest payments are recorded and purchase discounts are accreted as shown in the prior example using IN+ and ACR transaction codes respectively. An INW transaction should be used for interest if the interest payment is paid to the portfolio owner, rather than being credited to portfolio cash. If you are manually entering the data, highlighting the Amount field and clicking the "calculator" icon will cause the Amount field to be conveniently computed for these transactions. See Bond Discounts & Premiums for more information on these computations.

Discount Accretion - Accretion (ACR) transactions for bonds purchased at a discount may be entered at any frequency, however, a single year-end entry for tax purposes typically is required as a minimum. A final accretion transaction should also be entered at the time of a bond sale or maturity redemption. Accretion transactions need to have lot number assignments matching an opening purchase transaction only if more than one lot is open. If multiple purchases were made in the same bond issue, accretion transactions may be assigned to individual purchases by assigning specific tax lot numbers. Accretion transactions may be taxable events as indicated by the positive amounts in the Est. Taxes field in the above example. Accretion transactions also increase the bond's taxable cost basis, so as to reduce capital gains to zero if the bond is held to maturity.

Accrued Interest - This field in the BUY and SLL transactions records the accrued interest paid by a bond buyer when a bond is purchased after original issue, and likewise records accrued interest received if the bond is sold prior to maturity. The Accrued Int. field may be computed by highlighting and clicking on the calculator icon (or executing Data/Compute command), but it is preferable to enter these manually from the trade confirmations as the calculational methodology may differ slightly between the brokerage and Captools/net due to differences upon how you have specified the bond in the security Id record.

Cost Basis - The bond cost basis is computed upon entry of the SLL (or SLW) transaction and it held in the Aux Amount field. The cost basis includes the original purchase price and commission plus any subsequent discount accretion amounts or less any premium amortization amounts (see example below). The cost basis does not include the accrued interest paid upon original purchase as this is considered interest income and is reported as such in income reports.

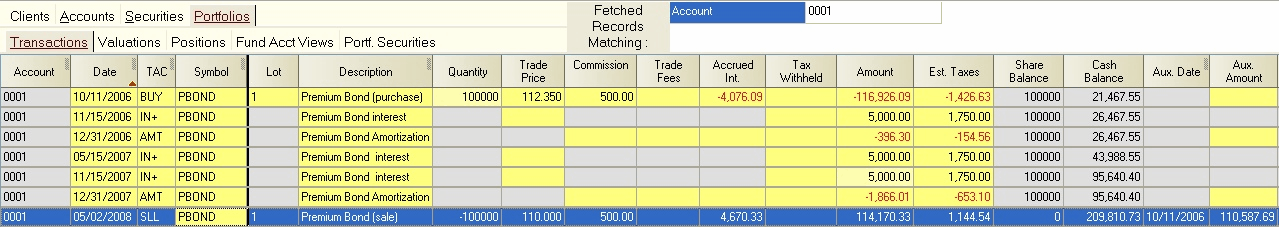

Premium Amortization - Amortization transactions for bonds purchased at a premium operate in a fashion very similar to bond accretion, except that amortization works in the opposite direction by reducing taxes and decreasing bond cost basis. The following example of a bond purchased at a premium, and sold prior to maturity shows how interest and amortization transactions are entered:

Batch Accretion/Amortization Transaction Generation

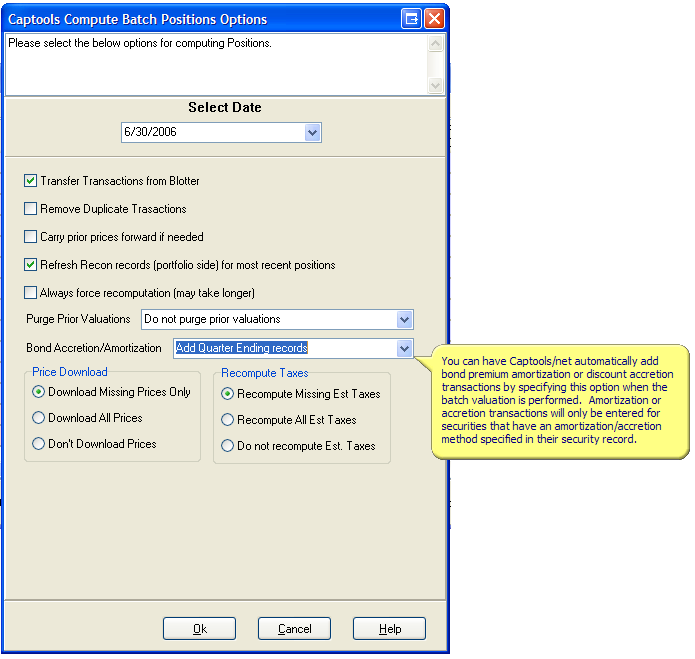

Bond discount accretion and premium amortization transaction can be generated during the batch valuation process by specifying addition of such for month, quarter or year ending valuations as shown below.