|

Credit/Debit Interest |

|

|

|

|

Credit/Debit Interest |

|

|

Credit/Debit Interest

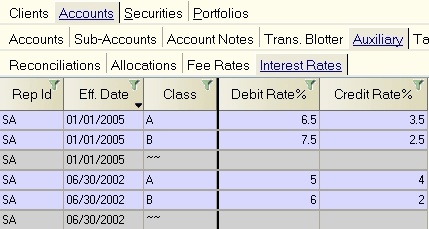

Captools/net Enterprise versions which have been licensed to support certain B/D features support the generation of credit and debit interest in client accounts. In order to activate Credit/Debit interest generation, you must create Account Interest Rate records:

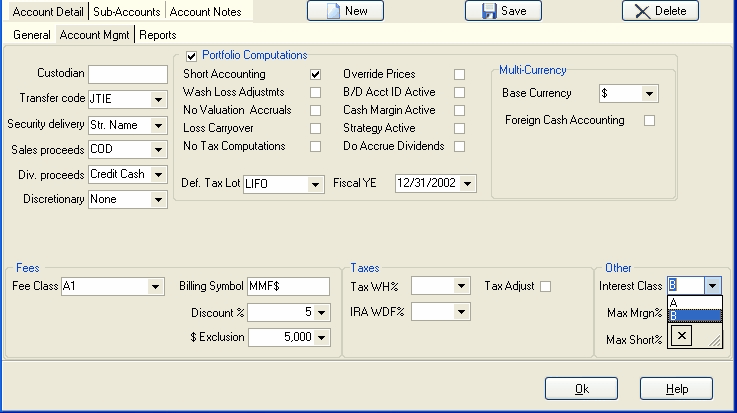

After the Account Interest Rate records have been created, each account for which you wish to generate credit and debit interest must be assigned an interest rate class from those that were defined in the Account Interest Rate records.

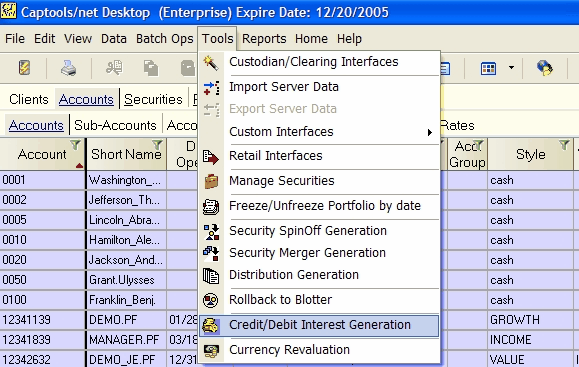

Credit/Debit interest rate records will be generated in the portfolio transaction records when the Credit/Debit Interest Generation process is run, either from the Desktop Tools submenu as shown below,

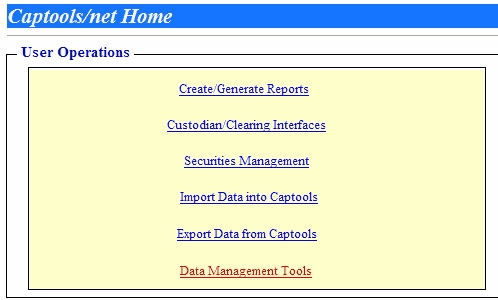

or from the Data Management Tools menu on the Captools/net Home browser page:

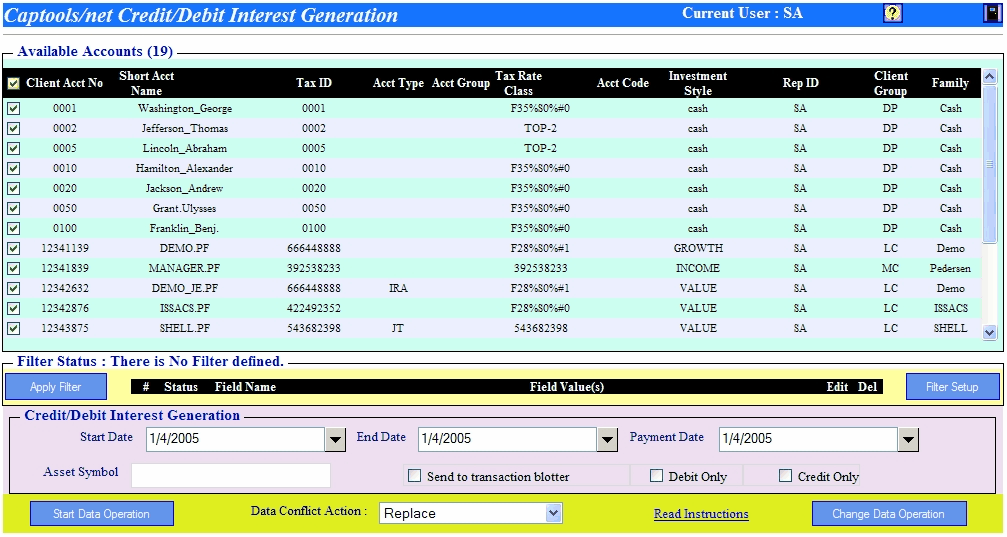

The Credit/Interest Generation data tool permits you to specify the accounts on which to operate, specify the date range, payment date, asset symbol to be credited or debited (blank defaults to Cash) and specify whether the transactions are to be inserted into the portfolio transactions or be first sent to the transaction blotter for review:

To finish, click on Start Data Operation. If the data was sent to the transaction blotter, you can review the resultant records in your Captools/net desktop program. Otherwise you can view the records in the portfolio transactions.

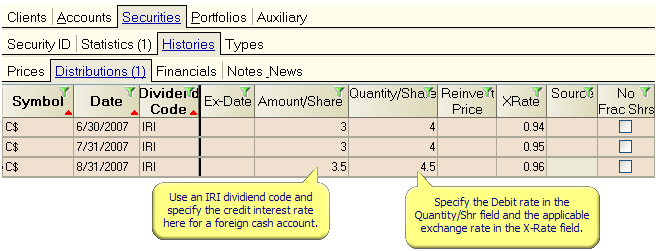

If the Credit/Debit interest is to be charged to a foreign currency account in a multi-currency portfolio using the "Foreign Cash Accounting" option, then you must use the Security Distribution Records to specify the credit and debit rates as follows in lieu of the Credit/Debit Interest Rate Records.

When you run the Credit/Debit function, you must specify the symbol of the applicable foreign currency in the "Asset Symbol" field of the dialog (see above). Credit or debit transactions will be generated using the "IRI" transactions code.