|

Security Statistics |

|

|

|

|

Security Statistics |

|

|

Security Statistics

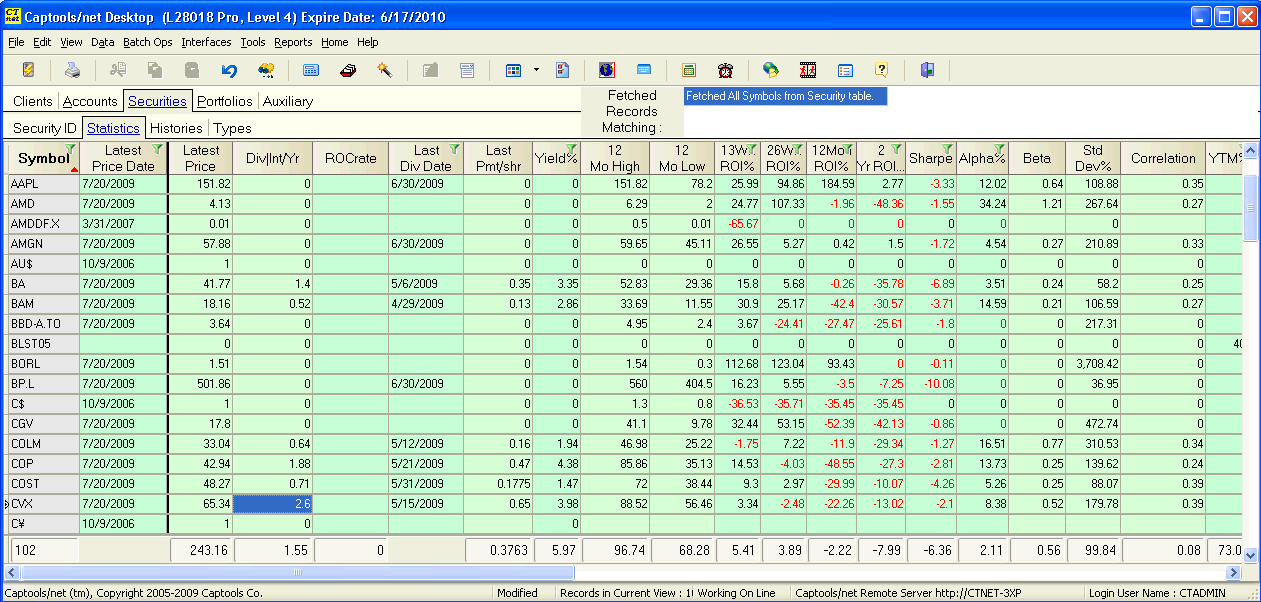

The Security Statistic records, appearing as follows, store and display various security measures that are useful in evaluating securities for investment and reporting to clients. Many of these statistics come from either imported data or from scheduled web downloads or are derived from such downloaded or imported data.

New Records and Data Updates - Security Statistic records for a given symbol are added whenever that symbol is added to the Security ID record table and are likewise removed whenever that symbol is removed from the table. The Statistics record is subsequently populated with whatever data is available from downloads whenever the next scheduled download occurs or when a download or import or relevant data is manually initiated. See Data Downloads for more information on downloads.

Relevant Records and Fields - Many security statistics are only relevant to securities which are shares representing equity holdings in a specific public company, i.e. "common stocks", Some fields, such as Dividend Rate and Yield% do have relevance for bonds and mutual funds, so these securities are also present in the table. Other list entries such as "(Cash)" or market indices may also appear in the statistics. You should ignore data in fields

"Edit" View - Since the Security Statistics are predominately a "View Only" fields type of record, there is no "Edit View" of this record.

The Security Statistics fields should be generally self-explanatory based on their labels. However the following fields bear additional note:

ROC rate - Return of capital rate, in money amount per share.

10-Day/3 Month Turnover - Trade volume for the specified time period (up to latest price date), divided by shares outstanding.

YTCall% - Yield to the associated call date.

YTRedempt% - Yield to the most likely redemption date.

Duration to Mat. - Bond Duration to maturity date.

Duration to Red. - Bond Duration to most likely redemption date.

Net Present Value - Discounted value of bond, at risk free rate specified in program preferences.