|

Security ID's |

|

|

|

|

Security ID's |

|

|

Security ID's

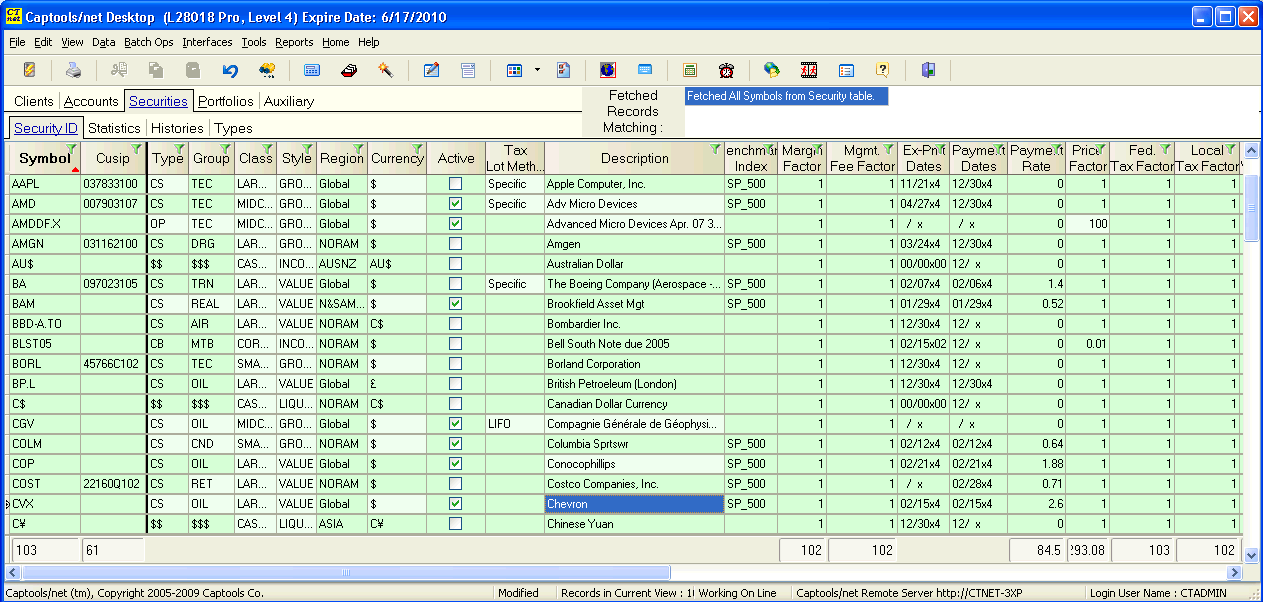

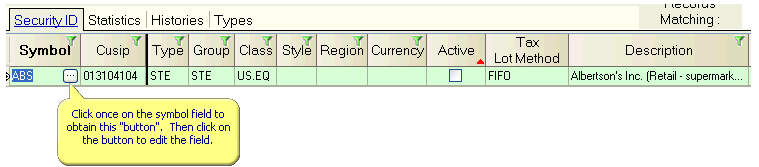

The Security ID records, appearing as follows, relate the security symbol with other security identification information such as cusip and description, as well as with other relatively static security specification information such as payment dates, price factors, maturity dates (for bonds), etc. These records also allow you to assign securities to a number of categories ("type", "group", "class", "style", "region") which can be used in grouping portfolio holdings in reports.

New Records - Much of the information in Security Id records is often provided at the Pro/Enterprise program level through imports of custodian provided data. At all program levels you will find that if you enter a symbol that is not in the security Id records into a portfolio, it will be automatically added to the Security ID records. This new record may consist only of the new symbol, with Captools/net default values for the other fields, or in some cases may also contain other information, such as description and payment dates and rates based upon a web lookup of this information. However, regardless of whether a new symbol is added to the list from an import or as a result of a manual portfolio transaction entry, you will generally need to edit the new record to assign to it the "type", "group", "class", etc assignments that you would like to use. Some securities, such as bonds or options may also need to have their price factor modified to conform with the pricing convention of these securities.

Deleting Security Records - Because other records in the data base may depend upon a security record, Captools/net performs several checks before deleting security records when you execute a Data/Delete Record or hit the Delete key. Security records can only be deleted if the "Active" field is "unchecked" and the record otherwise has no other records dependent upon it. When the security record is deleted, associated price history and other security "history" records will also be deleted.

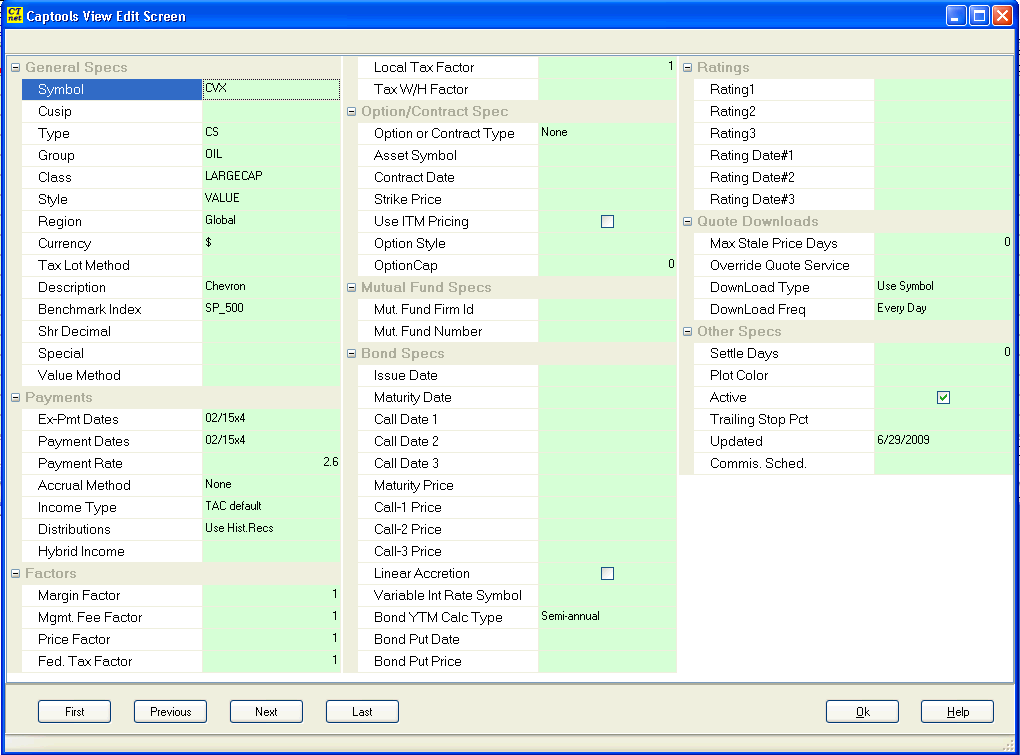

Record Edits - The tabular grid view shown above is useful for finding a security record, or for changing the value in a few fields. For more extensive editing, you should use the "edit" view, activated by selecting a record and then using the "Data/Edit" command. You can also double click on the record (except on the symbol field) to open up an edit dialog appearing as follows:

The Security ID record fields operate as follows:

General Specifications

These fields pertain to almost all securities, and are used to identify and classify the security.

Symbol - The contents of this field uniquely identifies the security within Captools/net. Typically the trading ticker symbol should be used in this field, however if a security does not have a symbol, its Cusip (see next) number may be used or you may construct your own symbol.

Cusip - This field is intended to hold the security's "Cusip" number. The CUSIP is a numbering system for U.S. securities, administered by Standard & Poor's. The contents of this field is not used internally by Captools/net except as an alternative reporting identifier and as an alternative identifier for downloading quotes. You may leave this field blank or use it to assign an identifier to download quotes from a download service.

Type - This field is intended to contain a short abbreviation indicating the type of security, e.g. "CS" for common stock, "MF" for mutual fund, etc. These identifiers are defined in the Security Types table. You may define your own identifiers there and use them in this field.

Group - This field is intended to contain a short abbreviation indicating the main industry group of security, e.g. "Retail", "Pharm", etc. These identifiers are defined in the Security Types table. You may define your own identifiers there and use them in this field.

Class - This field is intended to contain a short abbreviation indicating the security's investment classification. This can indicate the security capitalization size, e.g. "LrgCap", "MidCap", etc., or can be a categorization you devise. These identifiers are defined in the Security Types table.

Style - This field is intended to contain a short abbreviation indicating the security's investment style, e.g. "Growth", "Value", etc. These identifiers are defined in the Security Types table.

Region - This field is intended to contain a short abbreviation indicating region representing the security's primary market, e.g. "Namer" for "North America", or

"Global", etc., or can be a categorization you devise. These identifiers are defined in the Security Types table.

Currency - This field is intended to contain the identifier of the currency in which the security is traded. If your portfolios are invested in securities traded only in one currency, e.g. US$, then you can leave this field blank. However, if you are managing multi-currency portfolios, this field must be filled with the proper currency symbol for the security. (Note: a foreign security traded on a local market, e.g. the ADR of Sony, which is traded on the NYSE, would have the same currency identifier as a U.S. security, e.g. IBM). Multi-currency capability is supported as an optional feature on higher levels of the software.

Tax Lot Method - This specifies the default tax lot method to be used for this security, when a new transaction using this security is entered in a portfolio, and no other tax lot methodology is currently in use for this security in this account. If the tax lot method is blank or "unassigned", the tax lot method specified in the portfolio account record will be used. See Tax Lots and Cost Bases for more details on tax lots.

Description - This field contains the security description used in reports, and which is also used as the default description for portfolio transactions involving this security.

Benchmark Index - This field optionally specifies a market index against which this security's performance is to be compared. If different securities have different Benchmark Indices, Captools/net reports can construct a "blended" index for performance comparison based upon the value weighted average of benchmark indices. If Captools/net "Intra-day Gains" viewing is activated, and a security is a mutual fund, Captools/net will assign intra-pricing to the mutual fund based upon the price changes in the benchmark index. That benchmark could be an ETF if one exists which closely matches the relevant mutual fund.

Shr Decimal - This field specifies the number of decimal places to which share quantities will rounded when they are computed during manual data input.

Special - This field allows you to designate that the security is either a "money market fund", a "market index" or "model portfolio". Applying these designations will cause transactions and reports involving this security to be handled accordingly.

Value Method - This field allows you to specify how the security is to be valued, e.g. "Close Quote" (for most securities), "Zero Price" (for worthless securities), Unit Price (for money funds and similar), "Previous Position Price" (for securities whose value is infrequently quoted), etc.

Ex-Div Dates - This specifies the dates that the security goes "Ex-dividend". The notation that must be used for this field is "mm/ddx##" where "mm" is the month of the first ex-div. date of the year, "dd" is the day of the first ex-div. date of the year and "##" contains the number of payments in the year. So a security going ex-dividend on the 15th day of the first month of the quarter would have a specification of "01/15x04". If the ex-div. date is at the end of the month, use "31" for the day. Since Ex-div. dates sometimes vary from quarter to quarter, you may specify the "Next Ex-Div Date" in a later field in this record in order to specify the exact date.

Payment Dates - This specifies the dates that the security pays its dividend or interest. The notation is the same as described above for the Ex Div. Date. Since payment dates sometimes vary from quarter to quarter, you may specify the "Next Payment Date" in a later field in this record in order to specify the exact date. A security with a single payment at maturity such as a CD must have a notation with "0" in the frequency field, e.g. "10/31x0" for a maturity on 10/31.

Payment Rate - This specifies the annual dividend or interest rate for the security. In certain computations and reports the contents of this field will be superseded by downloaded data appearing on the "Security Statistics" record for the same security.

Note: The above three fields are provided for backward compatibility with data from prior versions of Captools software. It is now preferred to use the security Distribution records to specify distribution information for dividend accruals and forecasts)

Accrual Method - The accrual method to be applied in computing bond interest accruals, pending dividends on non-fixed income securities (higher levels only) and estimated accrual of income on cash and cash equivalents (higher levels only). The method to be used for bonds can vary depending upon the convention for various types of bonds. All accruals require appropriate entries in the payment dates and rates field. Rates for non-fixed income securities (e.g. common stock) and cash and cash equivalents are taken from the applicable security distribution records base upon the distribution record date (if "Distributions" field set to "Use Hist.Recs."). In the case of cash equivalents, the "Amount/share" in the security distribution record for the cash equivalent security should be the rate in effect expressed as an annual percentage rate (i.e. use "5" for 5% annual rate).

Income Type - This field allows you to specify how paid out income on this security is to be characterized. If you leave this at the first setting "TAC default" the transaction code (and possibly symbol, if money market fund) of a particular transaction will characterize the income.

Distributions - This fields allows you to control whether the security whether the security distribution figures for dividend accruals, dividend forecasts and distribution generations come from the Security Distribution records or from the "Ex-Div Dates", "Payment Dates" and "Payment Rates" fields in the Security Id records. The current options are as follows:

Exclude - Means to exclude from distribution generation and computation of rates and yields.

Security Id Rate - Means that the Security Id Record Payment Dates and Rates (above) will be used for computing current rates and yields for reports, etc. This usually appropriate for fixed income securities whose rates do not change over time.

Most Recent History - Means that the most recent income payment in the distribution records times the frequency will be used to compute rates and yields. This usually appropriate for common stock securities.

Trailing 12 Month - Means that the sum of the trailing 12 month income records in the distribution records will be used to compute rates and yields. This usually appropriate for mutual fund/ETF securities.

Lower of TTM/Last - Means that the lower of the "most recent history" or "trailing 12 month" record results will be used to compute rates and yields. This provides a more conservative outlook that might be appropriate in difficult economic times.

DistrPrice>Index ROI - Means that the distribution record "Price" will be used for computing an Index ROI.

If you do not have a good source to populate Captools distribution records, there is a reporting option to compute rates and yields using transaction data from the accounts being reported. This does have a drawback in that recently purchased securities will not have any history.

Bond Yield to Maturity will be computed using the Distribution records if no payment frequency is specified. This is to support fixed income securities with irregular payment dates and amounts. In this case, you must enter the anticipated payment dates and rates in the Security Distribution Records, and these will be used to compute yield to maturity.

Hybrid Income - This field allows you to indicate that imported income transactions include return of capital (ROC). During import the ROC component will be computed by deducting the indicated payout rate in the "Payment Rate" field from the imported payment amount. The ROC amount will be place in the transaction's auxiliary field.

Factors

Margin Factor - This specifies how much of the value of a security may be applied for margin borrowing in an account. A factor of "1.0" means that the full value of the security can be borrowed, e.g. if you hold shares of "XYZ" worth $50,000, the broker can lead you $50,000 against that security if you have a marginable account. Margin computation features are functional only on higher levels of the software.

Mgmt Fee Factor - This specifies a factor to be applied in computing investment management fees. This would be applicable if your fee structure specifies that the rate is dependent upon the type of securities held in the client's accounts. Thus if you agree to only charge half your standard rate for fixed income, you would specify "0.50" in this field for fixed income securities. Management fee computation features are supported only on higher levels of the software, and the fee factor applies only to higher levels of the Pro and Enterprise versions.

Price Factor - This specifies a factor to be applied when computing the value or amount of a security using the market or trade price and the share quantity. This factor is normally "1.0", but typically is "0.01" for bonds and "100" for options.

Fed. Tax Factor - This factor is applied to estimated tax computations performed against this security. A factor of less than "1.0" reduces the assumed federal tax,

and a factor of "0" is assumed to indicate that interest or dividend income (not realized gains) is tax free at the federal level.

Local Tax Factor - This factor is applied to estimated tax computations performed against this security. A factor of less than "1.0" reduces the assumed state and local tax, and a factor of "0" is assumed to indicate that interest or dividend income (not realized gains) is tax free at the local level.

Tax W/H Factor - This factor specifies a fraction of interest or dividend income which is to be placed in transaction "Tax Withheld" field.

Option Specs

These fields pertain to options to sell or buy a security (puts & calls, and employee options) and can also be used for futures contracts. These fields should only be used if this Security ID record is an option or similar security.

Option Type - Specifies whether an option is a "Put", "Call", "ESO" (employee stock option), or "CFD" (contract for difference). These are covered elsewhere in more detail.

Asset Symbol - This specifies the option's underlying asset symbol.

Option Contract Date - Contains the expiration date of the option.

Option Contract Strike Price - Contains the option contract or "strike" price.

Use ITM pricing - If this is checked, then "In the money pricing" is assumed for valuing the option. ITM Pricing assumes that the market value of the underlying security is used, and the implied value of the option is computed using the difference between the strike price and the underlying security's market price. If you plan to use option quotes to value the option, this field should not be checked.

Option Style - Permits you to specify "American" or "European" style of option.

Option Cap - Permits you to specify the option's cap if applicable.

Mutual Fund Specs

Mut. Fund Firm Id - This field allows you to assign a common identifier for funds from the same fund family.

Mut. Fund Number - Often fund families have their own fund identifier other than the trading ticker. This field can be used to record that identifier.

Bond and Accrual Specs

These fields pertain to fixed income securities only.

Issue Date - Bond issue date.

Maturity Date - Bond maturity date.

Maturity Price - Bond maturity price. Typically, by convention, the price is "100", however in this case be sure to use a price factor of "0.01". Maintaining consistency in bond pricing is important. In some cases different custodians can use different pricing conventions, causing a problem if you change from one custodian to another. If this occurs, you can highlight the Maturity Price field for the bond and use the "Data/Compute" function to normalize the bond's historical pricing to be consistent with your current custodian's usage.

Call Dates/Prices (3 fields) - You may specify up to 3 call dates and associated call prices. These will be used in the computation of yield to most likely redemption.

Linear Accretion - The accretion of bond discounts or amortization of bond premiums is normally computed using the "constant yield" method specified by U.S. tax law. Checking this option causes accretion or amortization to be computed on a time linear basis.

Variable Int. Rate Symbol - If the security is a variable interest rate type of security, this field specifies the symbol of the security which is used to specify the variable rate.

Bond YTM Calc Type - By convention most bond computation tools state bond yields assuming a semi-annual payment. Thus a bond paying $30 per $1000 twice a year is a 6% bond. However, if you specify "annual" a rate of something like "6.09" is computed upon the assumption the first payment can compound at the indicated rate.

Bond Put Date and Price - Date and price at which a bond holder can redeem the bond prior to maturity, if this is applicable to the bond.

Ratings

Bond Ratings (3 fields) - These fields allow you to indicate the ratings of the various bond rating agencies, which can be later included in reports. If the security is not a bond, you can use these fields for applying your own ratings or those of analysts or brokerage firms.

Rating Dates - The dates the ratings in fields above where issued.

Quote Downloads

These fields pertain to price quote and other security data downloading. More information on download is found in the topic Data Downloads.

Override Quote Service - This specifies the name of any custom quote service that is to be used for this security. Normally this field should be blank.

Download Type - Specifies whether to use the symbol or the cusip as the security identifier for downloads, or whether to skip downloads for this security.

Download Freq - Specifies how frequently scheduled downloads should be performed for the security.

No Price - Specifies that a security is to have a zero price, as when a security is worthless or has no determinable value.

Max Stale Price Days - When valuing portfolios, if a price cannot be found matching the valuation date, Captools/net will apply the latest earlier price provided that the elapsed time does not exceed the "Max Stale Price Days". This is useful for securities which do not have downloadable prices and which do not fluctuate greatly in value, thereby reducing the need to manually lookup prices.

Other Specs

Settle Days - Allows you to specifies the number of days allowed for trades in this security to settle. This is used to compute the "Unsettled Quantity" field on position and reconciliation records.

Plot Color - Specifies the color to be used for this symbol in reporting plots such as pie charts.

Active - When checked, this field indicates that the security is currently held in at least one account or has been traded in the recent past where, and thus can be deleted unless it is currently or previously used in a portfolio.

Trailing Stop Percent - Permits specification of a stop loss percentage for a security. Currently not applied in any computation or report.

Updated Date - Allows you to specify most recent date the record was updated.

Commission Schedule - At certain higher software levels allows specification of a commission rate for the security.

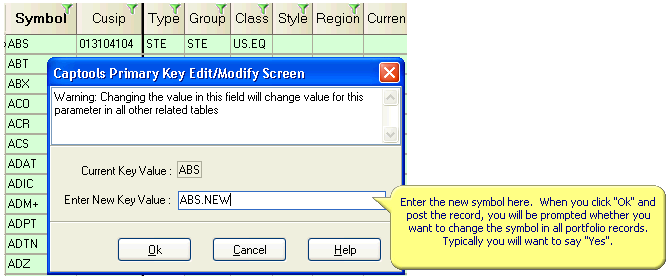

Symbol Change

Sometimes it is necessary to change a security record symbol, either because it was originally incorrectly entered, or the ticker symbol for a security has officially changed. You can change a symbol by clicking on the field in the Security Id record "grid" viewn then clicking on the small edit button to open an edit dialog:

Lower Case to Upper Case Symbol: Captools/net generally only uses upper case symbols. However, it is theoretically possible that a symbol containing lower case letters could get into the database through an import or data conversion. Leaving these as lower case will cause problems in reports and other operations, so you will need to change these to upper case. This can be done using the symbol editing described above. However, if you simply change "abc" to "ABC" this will not be recognized as a change for purposes of changing symbols. So in this case, you should first change "abc" to something different, e.g. "abc-d" and then change that to "ABC".

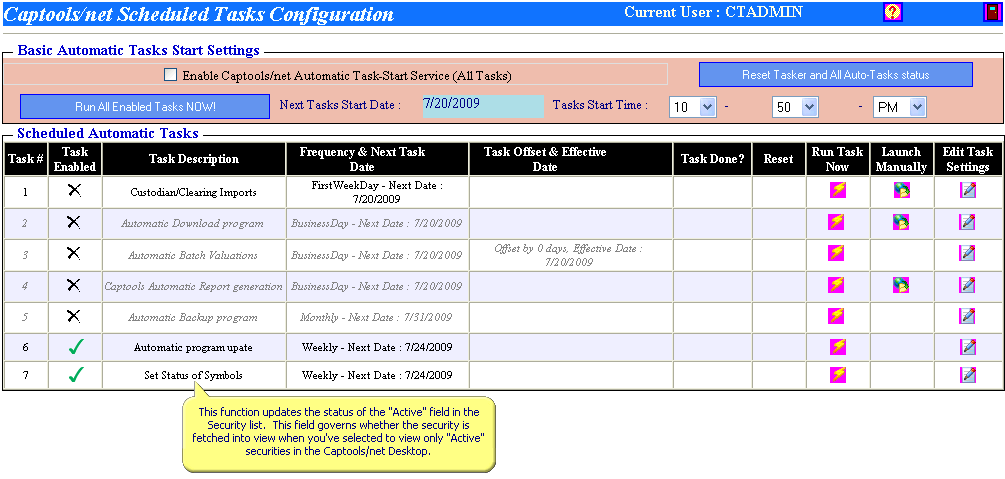

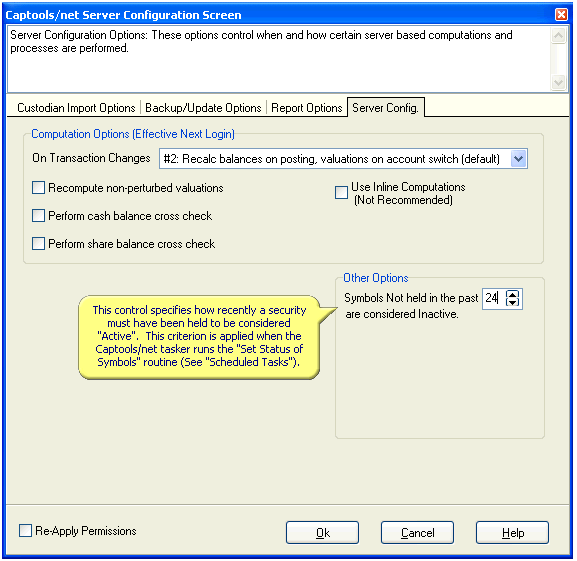

The security record "Active" Status field controls whether the record will be visible in the Security ID and Statistics tables if the Captools/net Desktop user has the "Symbols Retrieval" specification set to "Active Records Only". The "Active" field is updated periodically via a Captools/net Tasker process which sets the field based upon whether the security has been active in any account for a time period specified in the Captools/net Control Panel "Configure Options" records or which appears in the reconciliation, transaction or allocation records or which was a manually inserted security record: