|

Valuations |

|

|

|

|

Valuations |

|

|

Valuations

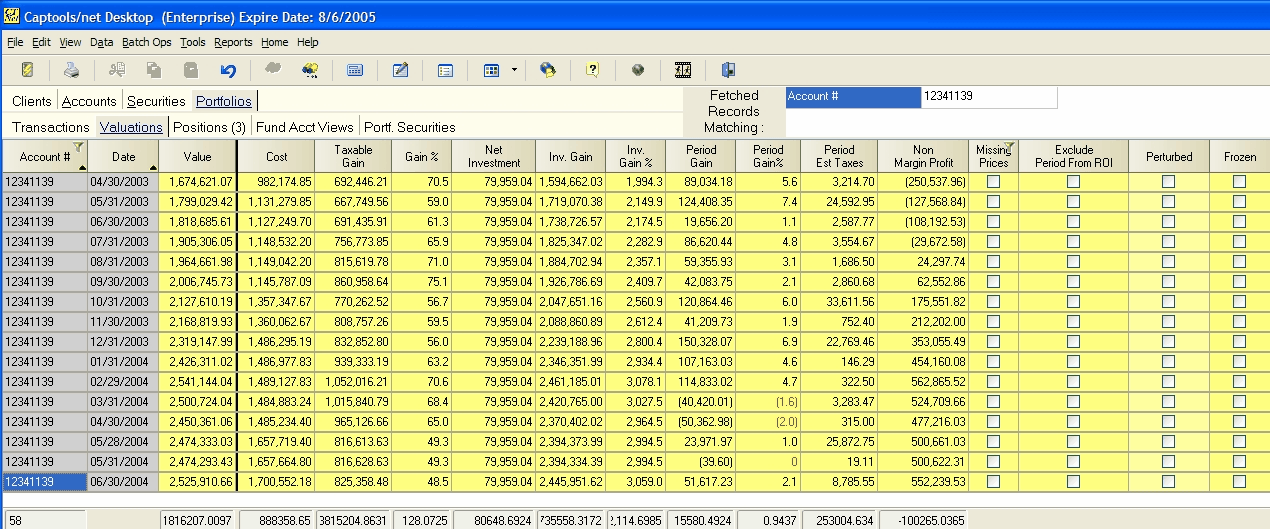

Portfolio Valuation records maintain a historical record of portfolio values and other portfolio metrics such as cumulative investment gains, period gains, and at higher program levels, margin information. Each valuation record has associated with it a set of Position records. These position records represent the Portfolio holdings and their associated values as of the valuation date. The typical standard Valuation grid view appears as follows:

New Records - Although new valuations may be generated on this screen simply by entering a new record, valuations are typically generated through the Batch Valuation function, or are generated by the Captools/net Tasker at the periodicity that you have specified.

Periodicity - A minimum periodicity of monthly valuations, with the valuation date set to the last calendar date of the month is generally recommended. This allows you to run reports from the end of any month to the end of any other month, with the valuation and their associated position records providing the start and end value data. Some users may wish to have more frequent valuations such as weekly or daily. These will consume database space, eventually affecting data retrieval response time. If you wish to value daily, but only want to retain weekly or monthly results, you may use the end of week or end of month date for your most recent valuation and simply revalue that each day.

Valuation Record Fields

The valuation record fields are the sum of the underlying position records. As such, they contain mostly computed values and thus may not be edited excepting one check box field at the end of each record, and the date field in a new record. The valuation record fields are as follows:

Account - Account number of portfolio.

Date - Valuation Date. You may enter/edit this field only for a new record.

Value - Total account value for the valuation date. This is the sum of the values of the underlying position records for this date.

Cost - Taxable cost basis of the portfolio as of the valuation date.

Taxable Gain - Value minus cost.

Gain % - Taxable Gain divided by Cost expressed as a percent.

Net Investment - Sum of all portfolio additions cash or securities minus all portfolio removals of same, over the life of the portfolio. This figure can go negative if more funds have been removed than have been added, not uncommon for a successful long term portfolio. (Cumulative Additions and Removals fields are normally hidden, but can be added to the valuation view using the "View/Manage View" command).

Investment Gain - Value of portfolio minus net investment.

Inv. Gain % - Investment gain divided by cumulative net investment, expressed as a percent, subject to net investment being greater than 1.0. Note that net investment can be negative if more funds are removed than invested, which can typically occur over a long period of time.

Period Gain - Change in investment gain versus the prior valuation record.

Period Gain % - Period gain divided by prior valuation plus period net investment, expressed as a percent.

Period Estimated Taxes - The cumulated estimated taxes for the transaction for the period based upon the transactions for that period. The Tax Calculations option must be turned on for the account for these to be computed.

Margin Interest - Accumulated margin interest since the prior period (Level 4)

Cash Available - Cash in the account

Margin Available - Total theoretical margin available in the account based upon current valuations. Note that the "margin factor" must be correctly set for each security held in that security's record for this figure to be correct. (Level 4)

Margin Used - The portion of total theoretical margin that has already been used. Again, this is subject to correct values in the security records for margin factors. (Level 4)

Margin Remaining - The portion of total margin that is still remaining to be used (subject to correct margin factors in the applicable security records) (Level 4)

Gross Value - Value of the the account after margin used is added back.

Leverage - Gross value divided by Total Account Value (net value) (Level 4)

Missing Prices - This check box is automatically filled when one or more of the underlying position records are missing prices. This must be corrected by opening the records to see which prices are missing and then either manually adding the prices or highlighting the price field and using the Data/Compute Field command to download/retrieve any available price for that date.

Exclude Period From ROI - This check box permits you to specify that the valuation period associated with the record not be used in reporting performance. This is particularly useful in generating composite performance across multiple accounts and you need to exclude one or more periods for one or more accounts.

Perturbed - This allows you to manually invalidate the valuation so that it will be recomputed when you run the Data/Compute Fields command or the next time that valuations are automatically recomputed.

Calc Date - This indicates when the record values were last computed.

Accrued Dividends - This indicates the value of accrued dividends as of the valuation record date. (Level 4)

Value w/o Accruals - This indicates the account value without accruals included. (Level 4)

Est. Accrued Fees - This indicates the computed value of accrued (not yet billed) account management and incentive fees. To populate this field with data, the fee record for the account must have the "Accrued Fees" field checked. (Pro 4)

Valuation Re-Computation

As previously noted, Valuation records for a given account represent the sum of underlying Position records of the same date for the same account. These position records are computed based upon prior position records and intervening transactions for the applicable account. Changes made to prior position records or transactions generally automatically "ripple" down to update subsequent position and valuation records, eliminating the need to re-compute such records. However, recomputation of valuation records and associated position records can be "forced by highlighting Date and/or Value field of the record from which the computation is to begin and then using the "Data/Compute Fields" command (or "Compute" icon) to trigger the recomputation. The selected record and all those of a later date will be recomputed with a lookup for any missing prices. This process may take some time depending upon the number of records in the portfolio. If you need to do this for a number of accounts, and/or you want to avoid tying up the interface while the computations proceed, you should instead use the "Batch Ops/Batch Valuation" function. This permits re-computations for multiple accounts and returns the user interface immediately during computations because it is performed in a separate process by the Captools/net Tasker.

Missing Prices Lookup

If valuations do not need recomputing, but you want Captools/net to try to lookup missing prices, select the "Missing Prices" column in the Valuation records for the applicable records, and then click the "Calculator" icon (or "Data/Compute"). This will generally operate faster than a full Valuation Recomputation.