|

Positions |

|

|

|

|

Positions |

|

|

Positions

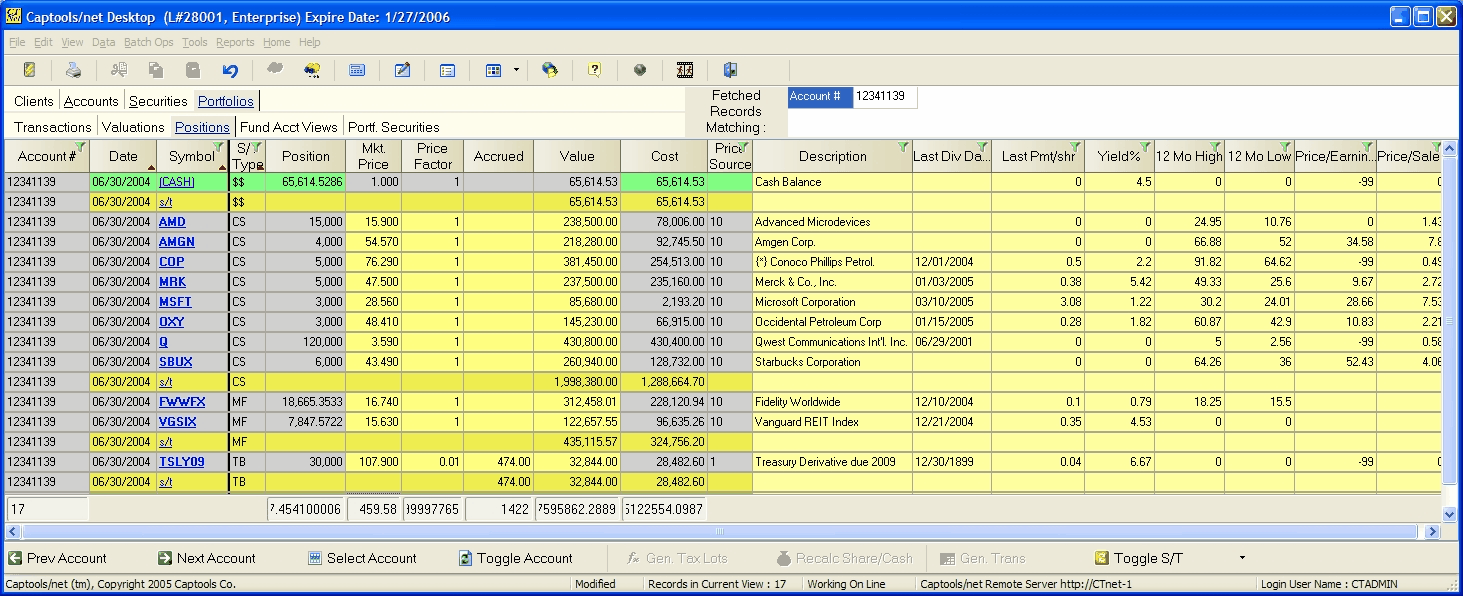

Portfolio Position records maintain a historical record of portfolio values at the security detail level. The position records are the basis for portfolio holdings reports and are useful for quickly viewing portfolio holdings without the need to generate a report. The typical standard Position record grid view appears as follows:

New Records - Position records are generated whenever a valuation record of the same date is generated, whether by manual creation of the valuation record or as part of a batch valuation process or an automatic CTTasker generated valuation.

Position Record Fields

The Position records contain values which are computed from prior portfolio position records and intervening portfolio transactions. Changes made to prior position records or transactions generally automatically "ripple" down to update subsequent position records, eliminating the need to re-compute such records. However, recomputation of position records and associated valuation records can be "forced" by highlighting Valuation records and then using the "Data/Compute Fields" command.

Most Position fields contain computed or retrieved values and can not be edited, excepting the Mkt. Price field and the Exchange Rate field (multi-currency views). The fields function as follows:

Account - Account number of portfolio.

Date - Date for which the position is valued.

Symbol - Security identifying symbol, typically a ticker symbol or cusip number.

S/T Type - A security "Type", "Group", "Class" etc. used to group and sub-total the position records in the grid view.

Position - Number of shares held. This value is computed from the account transactions prior to and including the position date.

Mkt. Price - End of day Market Price for the security for the position record date. Normally this information is imported or downloaded, but the price can be manually entered if pricing is not available by import or download.

Price Factor - This is a multiplier retrieved from the Security Id record. Normally this has a value of "1" for common stock and mutual funds, but typically is "0.01" for bonds and "100" for options, but may vary from security to security. If the incorrect price factor appears here, you must correct it in the security id record and recompute the position record.

Accrued - This field contains the computed accrued interest for bonds or optionally, computed accrued dividends for common stocks (higher versions only) and or cash and cash equivalents (higher versions only). This value may be manually overridden. Computation of accruals requires prior setting of payment dates and rates and accrual methods in the security record for each security (see Security IDs). Accruals for dividends requires specifying "Pending Dividends" as the accrual method for such securities. Please see the advanced appendix topic Dividend Accruals for more detail on implementing dividend accruals.

Accruals on cash and cash equivalents is NOT added into the value for these securities since the unaccrued value is typically needed to determine cash available for trading. However, accruals on cash and cash equivalents are included in cash flows used for computing ROI performance in reports as allowed by CFA-AIMR-GIPS standards. If you use accruals on cash and cash equivalents it is suggested that you footnote your applicable reports regarding this since the end value field in such reports will only reflect the actual balance on hand as of the report date.

Value - This field is computed by multiplying the position shares times the market price times the price factor and adding the accrued amount, if any. If the security is a "foreign currency" denominated security in a multi-currency portfolio (optional feature), the exchange rate for the date is used to adjust the value to the portfolio base currency. Options may optionally be valued using an "in the money" algorithm if this method is specified in the Security Id record.

Description - This description is retrieved from the Security Id record.

Other Retrieved Fields - Other "temporary" fields may appear in the position records which contain values retrieved and/or computed from the Security Id or Security Statistic records. These are useful in assisting you to review your portfolio holdings.

Multi-Currency Fields - A "Multi-Currency" position view is available using the View/Manage View command for program versions supporting multi-currency accounting. This view displays fields for accrued income denominated in the security currency and also an "Exchange Rate" (X-Rate) field for specification of the currency exchange rate between the security's currency and the portfolio's base currency.

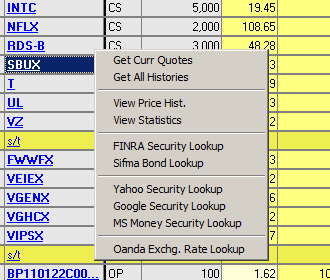

Security Lookups

Right-clicking on a symbol after selecting it on the Portfolio or Batch Position table opens a menu providing you with a selection of various web sources to lookup that symbol. On the Portfolio Position table the menu also provides the option to download quotes for that symbol or lookup exchange rates for non-base currency securities in multi-currency portfolios.